Despite concerns about inflation and recession, the demand for infrastructure cabling in field services continues to surge, driven by the proliferation of devices and the increasing need for bandwidth. In a recent poll conducted by Field Nation, an overwhelming 95% of respondents recognized the growth potential in this field.

Respondents in the Field Nation survey highlighted the strongest need for certain types of cabling projects, including:

- Retail equipment cabling installs, such as cash wraps and point-of-sale systems.

- Copper or fiber structured cabling for retail stores, data centers, large warehouses, and distribution centers.

- Cabling for network equipment and wireless access points.

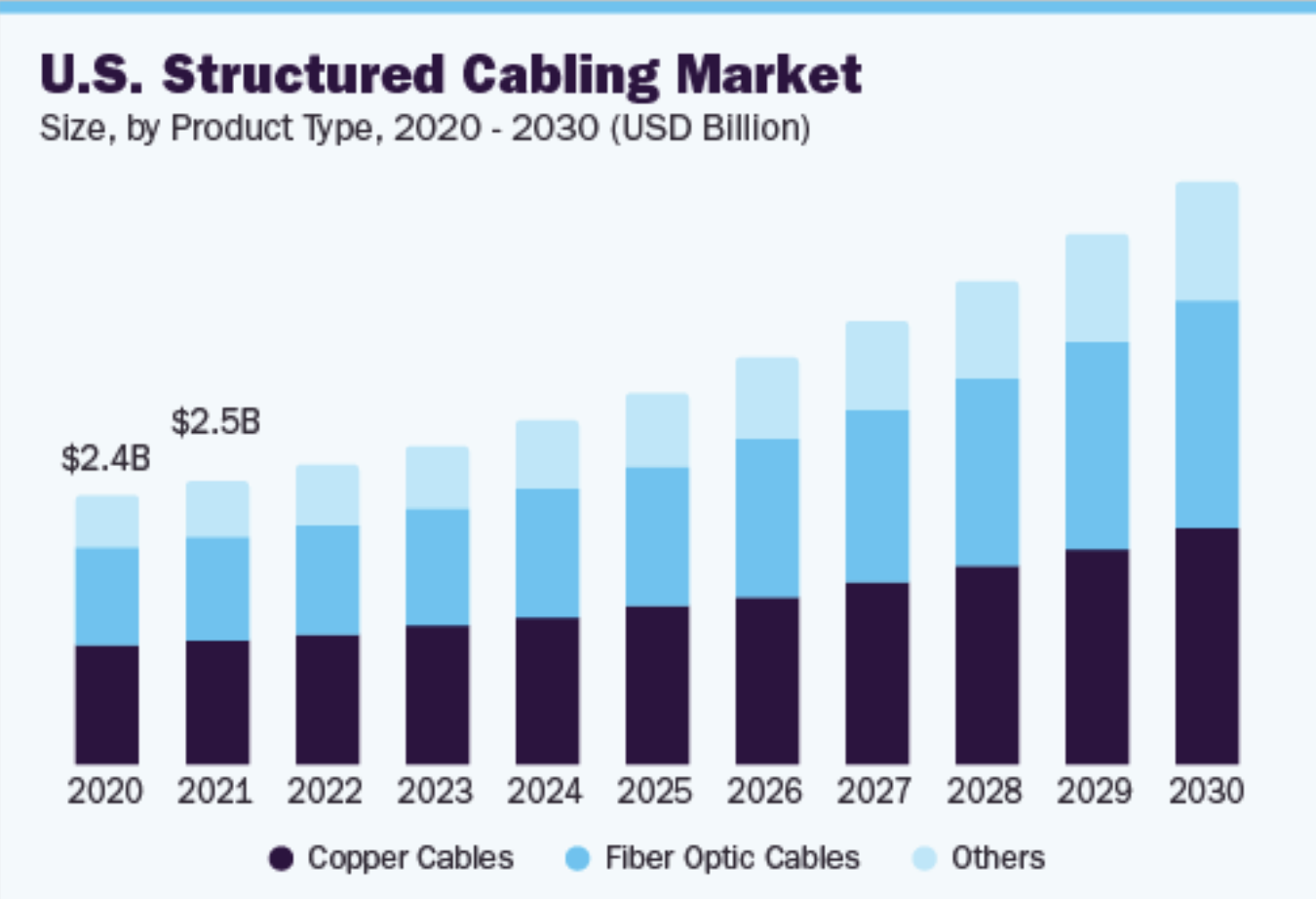

The continued requirement for connectivity has driven significant growth in both fiber optic and copper infrastructure. According to Grand View Research, copper dominated the market with 49.8 percent market share, while fiber has the highest annual growth rate.

Thomas Edmondson, VP of Operations at LMI Tech Systems, a full-service electrical contractor and system integrator, concurs, “We’re experiencing significant growth in all categories, with the wireless sector leading the way. As we emerge from the recession, we’re witnessing an increase in new store openings with WiFi offered at more locations. It’s an interesting paradox since wireless access points require wiring, resulting in the need for multiple cable types for each installation.”

Fiber optic cables are increasingly deployed in warehouses and distribution centers to meet the demand for high-speed and reliable connectivity. They are also essential for data centers that require bandwidth for cloud computing and big data processing. Fiber optic cabling is cost-effective, with higher data transmission rates and lower maintenance costs than copper. Initiatives like Fiber To The Home (FTTH) have supported high-speed internet connectivity and advanced services.

Similarly, the demand for reliable and scalable networking solutions has fueled the adoption of copper cabling, particularly in store openings, refreshes, and remodels. The emergence of 10-Gigabit networking and Power over Ethernet (PoE) technology has further contributed to the growth of copper cabling, offering faster data transfer rates and simplified installations. Also, copper cabling remains a budget-friendly option for organizations with cost constraints. These growth drivers have solidified the continued relevance and adoption of both fiber optic and copper cabling, providing vital connectivity across various applications.

The uninterrupted connectivity needed for other applications is intricately linked to the underlying cabling infrastructure. Public safety and security concerns have driven the adoption of access control systems and IP cameras, which are now more affordable compared to analog CCTV systems. Moreover, the consistent need for uptime has created opportunities in the cellular space, with installations of cradlepoint systems for cellular backups in case of WiFi or modem failures.

Ready to seize the opportunities in the thriving market for cabling services? Reach out to our team for valuable advice and customized solutions.