Field Intelligence: 3 strategies to improve MSP profitability in 2021

December 8, 2020

Field Nation’s EVP of Product Management, Wael Mohammed, has examined the data and identified key opportunity areas and growth strategies for 2021.

Field service opportunity is knocking

After the steep dip during the spring shutdowns, the market started recovering at the end of the second quarter and is leveling out to roughly -10% of 2019 levels. Some sectors have been hit hard while others have been less affected. We’re even seeing some products and services align strongly with the public’s changed safety needs and behaviors.

Digital signage and networking are recovering the fastest

Trends in the retail and restaurant industries are driving this demand.

- Overall, public health concerns have created a strong need for digitally connected, safe consumer experiences. This has given rise to trends from light-contact shopping like BOPIS (buy online, pickup in-store) and contactless shopping to the use of stores as fulfillment centers and the need for data-powered inventory management.

- While some retail sectors are suffering, grocery, convenience, and discount stores are enjoying strong sales. Meanwhile, online shopping is on track to grow from 17% to 30% of total retail. This has led to more spending on services like self-checkouts, mobile POS, large signage screens, item labeling, and reconfiguration of store layouts for curbside pickup.

- Independent and full-service restaurants are bearing the brunt of deep losses, while quick-serve restaurants are thriving, with drive-thru and carryout leading the way. This has prompted spending on technologies like contactless order and pay, drive-thru cameras and voice tech, outdoor menu boards and screens, and food delivery pickup lanes.

Opportunity does exist in the current economic landscape. Where some sectors have weakened, others are stronger. Certain business models are less effective, but others seem designed for the moment.

Three key strategies to grow your profitability

After hundreds of conversations with MSPs, we understand the primary challenges to maintaining profitability. We’ve defined three key strategies that address these challenges and make you more nimble, cost-effective and able to scale — putting you in a better position to take advantage of market opportunities.

1. Use location-specific market data to make your bids competitive.

Bidding accurately is a constant challenge. Due to what we call the “margin one-rate squeeze,” sales teams tend to seesaw between bidding high to maintain the profit margin — and not getting the work — and bidding low, but then not realizing any profit from the work. These bids usually don’t factor in the cost of travel either.

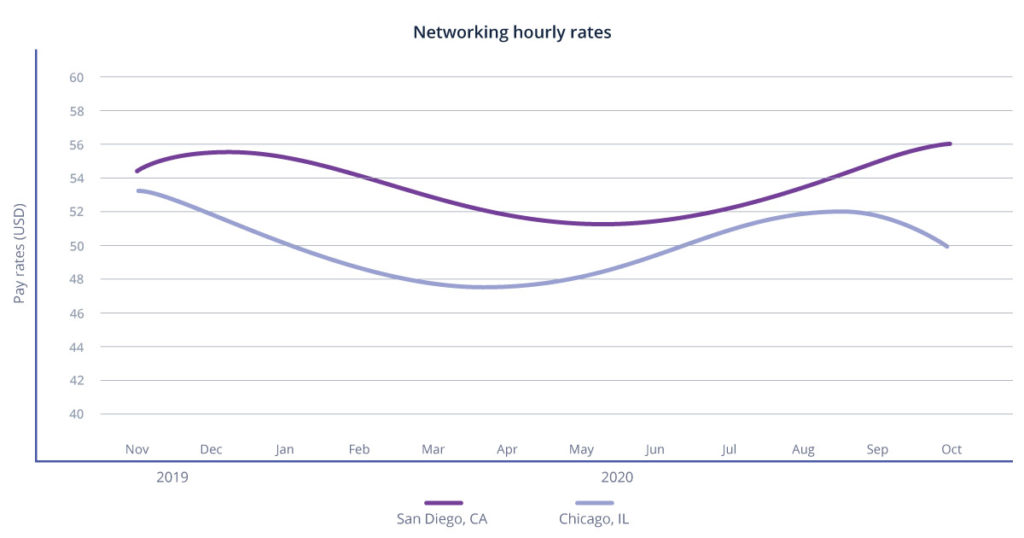

Often these teams use their own data captured in-house over time. But rates change constantly (see examples illustrated across 4 cities below), so this internal data rarely reflects the current market. The data is also typically based on national or regional averages. Yet rates can vary from 5% to 15% between locations — and that can be the difference between profitability and loss.

To win more bids and improve your margins, it’s critical to use up-to-date accurate market intelligence for specific locations. This will help you calibrate to any market, effectively account for travel, and price the work so it’s competitive without dipping into the profit margin.

2. Use a flexible labor model so your employees can work to their — and your — best advantage.

Your workforce is your most strategic asset, but a number of factors can prevent you from optimizing this resource:

- Lack of good coverage – Leads to increased travel and reduced profits.

- Giving employees lower-value work – While this is done to address underutilization, it doesn’t help the employee grow or develop new skills — which can lead them to feel frustrated or unfulfilled.

- Keeping employees on-call for maintenance contracts – When you work with stringent SLAs, you need a resource on-site fast. Leaving this work to your core W2s has been known to lead to employee burnout.

By introducing a flexible labor model, you can free up your W-2 employees for strategic opportunities while still providing coverage for project-based or repetitive high-volume break/fix work. You’ll be able to pursue opportunities more quickly and increase your win rate. And because you have more control over variable rates, your margins will improve.

3. Flex your service delivery costs up and down in response to market demand.

Fixed costs reduce agility and profitability. They trap cash and hinder investment in new customer acquisition and product innovation. While fixed labor costs are predictable, they also keep your service delivery costs static and inflexible, preventing you from quickly capturing market opportunity.

A flexible labor model with variable costs translates into equally flexible service delivery costs. You’ll be equipped to respond nimbly to a market that we expect to fluctuate aggressively in the next two to three years. This will put you in a highly competitive and profitable position for 2021 and beyond.

As the recovery unfolds, Field Nation will continue to deliver Field Intelligence insights to help you navigate the changing market.

__

Field Intelligence expert

Wael Mohammed has been in the IT services industry for more than 27 years. He has held leadership roles in both startups and large enterprises, including SPS Commerce, IBM, and Target. Wael is currently the Executive Vice President of Product Management at Field Nation, and oversees product management, product design, and data science. He is a master in identifying product and market growth opportunities, taking new products to market, and maximizing product performance.

RELATED RESOURCES

More from the field

- Field Service

- Industry Trends

- Field Service

- Product Updates

- Blog

- Best Practices

- Business Growth

- Blog