At a glance

- Field service trends for the first half of 2025 included continued growth in sectors such as data centers, AV systems, Windows upgrades, and low-voltage cabling.

- Retail-driven field service work remains steady, with remodels and system upgrades tied to store closures and new tenant activity.

- Break/fix and lifecycle services are on the rise, as organizations shift from capital projects to maintaining existing systems.

- Key field service challenges in 2025 include tariffs, high interest rates, and technician shortages—factors that also shape 2026 planning.

As we move into the second half of 2025, the themes are familiar: economic uncertainty, cost pressure, and market volatility. Yet, field service demand continues to grow in many categories.

Here’s a look at the tailwinds supporting field service activity—and the headwinds that could limit it.Tailwinds create field service opportunities

Growth areas to watch

Growth areas to watch

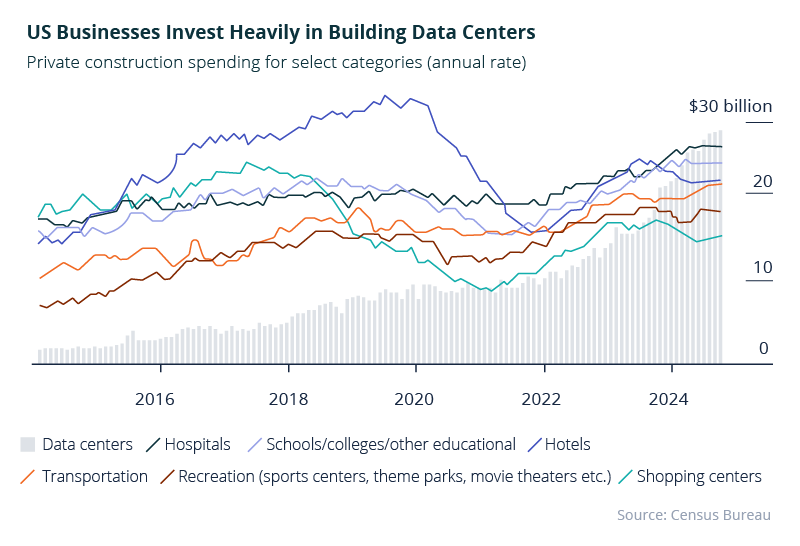

Many segments of field service are expanding, even in a cautious market. Data centers remain a bright spot, fueled by ongoing investment in cloud infrastructure and AI capabilities. The global data center construction market will grow at 11.8% through 2030, according to industry estimates.

Other work types—such as physical security systems and AV upgrades—show continued demand. AV is already tracking ahead of last year, with over 37,000 work orders completed in the first half of 2025, reflecting renewed investment in meeting rooms and digital signage.

Windows device work is surging, driven by concerns about tariff-related price increases and the upcoming end-of-life for Windows 10. More than 62,000 device-type work orders were completed in the first half of 2025, as SMBs move quickly to upgrade devices for better security and compatibility.

Low-voltage cabling is gaining traction due to infrastructure upgrades, store reconfigurations, and rising demand for connected environments. Nearly 56,000 work orders for cable testing and runs have already been completed in 2025.

Steady demand from retail store activity

Retail continues to be a key driver of field service work, even as store openings and closures reshuffle the landscape.

Core retail sales have grown 4.2% year-over-year, according to the National Retail Federation. Over 9,900 store closures have been announced since early 2024, but many of these were long-expected exits from struggling brands. Meanwhile, space vacated by these closures is already attracting new tenants.

This activity fuels consistent demand for decommissioning, remodels, and system upgrades, particularly across signage, cabling, POS, and access control. For field service teams, the work remains steady, even if the banners above the doors are changing.

Increased focus on lifecycle services

With some large capital projects on hold, many businesses are shifting to maintenance and repair. Break/fix work, preventative maintenance, and asset extension services are seeing renewed interest. This shift allows service organizations to strengthen relationships by helping customers keep existing systems running reliably.

Headwinds pressure business investment

Headwinds pressure business investment

Impacts from trade shifts

Recent trade policy shifts, such as tariffs, are raising costs for imported equipment and materials across the field service landscape. Some companies accelerated purchases earlier in the year, while others are waiting out the uncertainty. Either way, the ripple effects are slowing project timelines and increasing cost sensitivity across the board.

High cost of capital and macroeconomic strain

Borrowing costs remain elevated, with interest rates between 4.5% and 5%. The Federal Reserve has held rates steady, and it is concerned that lowering rates could reignite inflation. At the same time, first-quarter GDP fell 0.2%, partly due to a surge of imports ahead of price increases. Economists surveyed by the Wall Street Journal now see a 33% chance of recession, up from 22% earlier this year. These factors are causing many businesses to delay or scale back spending on field service projects.

Persistent technician shortages

Labor remains a constraint. While overall unemployment remains low at 4.1%, field service organizations continue to face technician shortages in certain skill areas and geographic regions. The challenge is most acute for complex, multi-site work and time-sensitive projects. As demand in specific sectors continues, the ability to flex labor capacity remains a key differentiator.

Strategic considerations for field service leaders

Work order activity remains strong on the Field Nation platform, with 631,000 work orders completed through June. In a shifting market, field service leaders must adjust their strategies to stay ahead.

Dig deeper into market signals: Avoid relying on broad economic headlines alone. Analyze growth and contraction at the segment level to see which sectors, store types, or regions drive work and which are slowing down.

Strengthen lifecycle services: As capital budgets tighten, prioritize services that help customers maintain and extend existing systems. Proactive break/fix, preventative maintenance, and performance upgrades can build stronger relationships without heavy upfront spending.

Flex your capacity: Keep on-demand labor options in place to handle seasonal peaks, store rationalization, or project changes linked to trade policy shifts. A flexible model allows you to adjust quickly.

Prioritize speed: In a volatile environment, responding fast can set you apart. Completing projects ahead of pricing changes or seasonal surges positions you as a trusted partner.

Power your projects with a flexible workforce

Field Nation makes scaling your capacity and responding to changing needs easy. Connect with our team to see how you can prepare for what’s next.

Check out these additional 2025 trends resources →

Dive further into these insights with the 1H2025 trends infographic

Read the definitive guide to field service trends