Contents

- 1. Historic field service market complexity

- 2. A structural talent deficit

- 3. Industry inefficiencies and performance challenges

- 4. Retail's physical and digital transformation

- 5. Security analytics and system convergence

- 6. AI-driven data center expansion

- 7. The convergence of audio-visual and IT systems

- The path forward

Field service leaders are facing historic complexity in 2025. A shrinking workforce, margin pressures, and shifting retail landscapes are redefining service delivery. Those who adapt with flexible labor models, cost-efficient operations, and strategic tech investments will position themselves for success.

Explore the key trends shaping field service—and how to stay ahead.

1. Historic field service market complexity

Field service leaders confront a perfect storm of challenges as market volatility collides with sticky service inflation and evolving customer demands. The current business environment presents the most complex operating conditions in the past 40 years, pushing organizations to fundamentally rethink their approach to service delivery.

Market conditions are mixed

- The U.S. economy shows signs of moderation with GDP growth projected at 2.3% for 2025

- Broader inflation measures are easing, but service-sector inflation remains persistently elevated

- The Federal Reserve has indicated plans for modest rate cuts in 2025

- The high cost of capital, ranging from 15-16%, is significantly impacting investment decisions across industries

- Consumer spending patterns reveal mixed signals, with holiday retail sales growing 4% to $994.1 billion despite budget consciousness, according to the National Retail Federation (NRF)

Delayed customer projects are expected to return to market in Q2/Q3 2025, creating new service opportunities. Service organizations continue to face mounting cost pressures as inflation persists. High capital costs are pushing ROI requirements higher, while customers continue to defer non-essential capital investments.

Recommended actions

- Develop flexible pricing models that account for service inflation

- Build a variable cost structure to protect margins

- Focus on cost-reduction projects that extend asset lifecycles

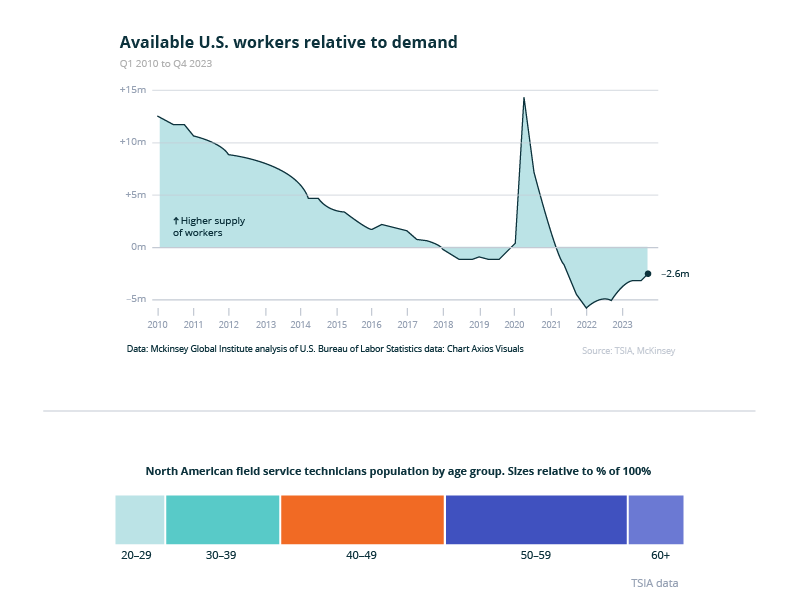

2. A structural talent deficit

The skilled technician shortage continues to be one of the field service industry’s most pressing challenges. Demographic changes and evolving workforce preferences have created a talent gap that threatens service delivery, requiring new approaches to talent acquisition and retention.

Current workforce dynamics

- A worker deficit of 2.6 million exists across service sectors, with continued declines through 2023

- Interest from younger workers remains low, with only 40% expressing interest in field service careers

- Half of all field service technicians are now over age 50, creating urgent succession planning needs

- Some organizations report baby boomers returning from retirement to fill critical roles

- Geographic coverage gaps continue to widen, especially in tier 2 and 3 markets

Competition for skilled technicians continues to intensify, pushing labor costs higher and squeezing service margins. Organizations face mounting pressure from multiple directions: fewer young workers entering the field, widening geographic coverage gaps in secondary markets, and accelerating knowledge loss as senior technicians retire.

Recommended actions

- Develop hybrid workforce models combining full-time/part-time (W2s) and on-demand labor

- Create partnerships with trade schools and training programs

- Implement knowledge transfer programs from senior technicians

- Establish mentorship programs to accelerate skill development

- Leverage technology for better resource allocation

3. Industry inefficiencies and performance challenges

Field service organizations are struggling to maintain profitable growth while battling persistent operational inefficiencies. Industry data reveals systemic challenges in meeting both performance targets and customer expectations.

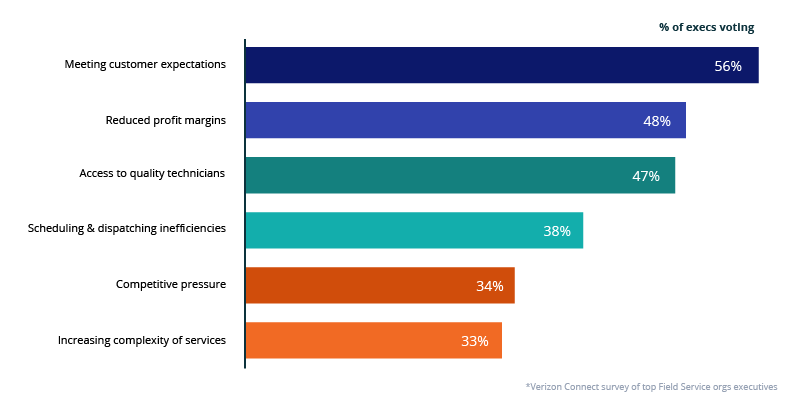

Major industry challenges

- Meeting customer expectations emerges as the leading concern, with 56% of organizations reporting difficulties in this area

- 48% report reduced profit margins, highlighting significant financial pressures

- Access to quality technicians affects 47% of organizations

- Scheduling and dispatching inefficiencies impact 38% of service providers

- 34% face mounting competitive pressure

- 33% note increasing complexity of services

Source: Verizon Connect survey of top field service executives

Low technician utilization and high travel costs continue to squeeze profit margins. Organizations struggle to maintain service levels while finding it increasingly difficult to scale operations efficiently.

Recommended actions

- Implement strategies to reduce fixed overhead costs

- Optimize scheduling and dispatch processes

- Develop local talent pools to minimize travel time

- Create flexible staffing models to improve utilization<

- Build efficiency metrics into service delivery

- Leverage technology for better resource allocation

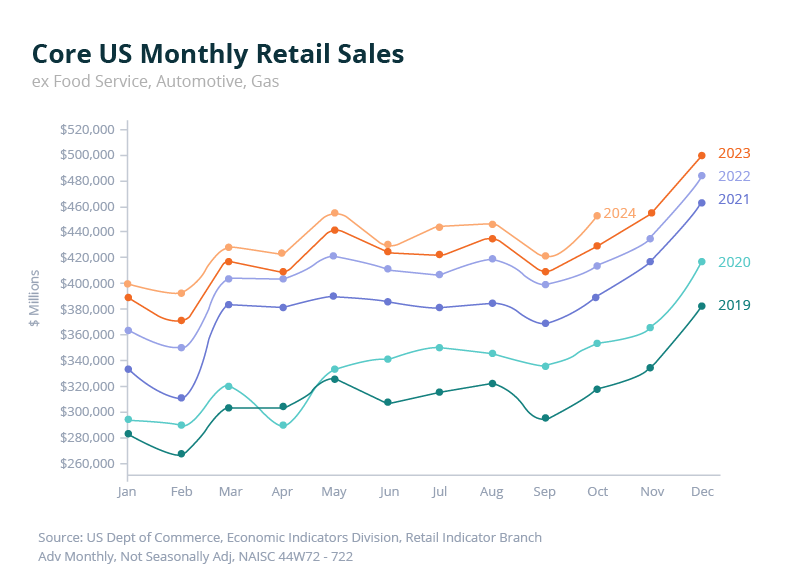

4. Retail’s physical and digital transformation

Retail operations are undergoing fundamental changes amid economic uncertainty, as organizations shift toward smaller store footprints while expanding digital capabilities. This transformation demands new approaches to service delivery.

Current retail landscape

- Core retail sales show relatively slower growth in 2024 compared to previous years, with growth slowing in discretionary categories

- New store openings remain steady with 5,800 announced for 2025, with Dollar General and Dollar Tree accounting for 1,300 locations

- The retail environment faces unprecedented consolidation, with Coresight Research projecting up to 15,000 store closures in 2025, the highest since the pandemic

- Market leaders like Amazon, Costco and Walmart continue gaining share while regional retailers struggle

Store format evolution

- Historic shift to more efficient store layouts, with the smallest average store size in 17 years (3,200 sq ft in 2023)

- Mass closures of traditional department stores and big boxes

- Conversion of remaining stores to support omnichannel:

- Enhanced pickup/return infrastructure

- Micro-fulfillment spaces

- BOPIS solution

- Technology infrastructure requirements

- RFID and smart inventory systems enable real-time tracking

- Integrated POS systems connect with fulfillment platforms

- Digital signage and wayfinding support customer navigation

- Self-service kiosks expand customer service options

The projected closure of 15,000 retail locations in 2025 creates significant near-term opportunities in decommissioning services, while also accelerating consolidation of geographic coverage needs. For remaining stores, rapid response times remain critical as downtime impacts fulfillment operations. Service organizations face growing complexity from interconnected systems and increased demand for multi-skilled technicians.

Recommended actions

- Scale capabilities for large-volume store decommissioning while maintaining conversion expertise

- Build expertise in small-format retail equipment and systems

- Create efficient processes for multi-site technology rollouts

- Optimize workforce models for high-volume store closures while maintaining flexibility for evolving coverage needs

5. Security analytics and system convergence

Security systems are evolving beyond traditional surveillance as retailers combat rising theft and seek deeper business insights. Modern platforms combine AI-powered loss prevention with analytics for consumer behavior, store layout, and operational efficiency.

Current trends

Advanced loss prevention

- Retailers report a 93% increase in shoplifting incidents and 90% increase in dollar losses since 2019, according to an NRF study

- AI-powered surveillance enables real-time pattern detection

- Systems integrate with POS data to track unusual transactions

Analytics integration

- IP cameras provide shopper behavior insights

- AI technology analyzes consumer flow patterns and optimizes store layouts

- Smart search capabilities speed theft investigations

Security system maintenance requires broader technical expertise as platforms expand beyond traditional surveillance to include analytics and business intelligence. Organizations must support integrated systems across multiple locations while maintaining rapid response capabilities for critical security infrastructure.

Recommended actions

- Build expertise in integrated security and analytics platforms

- Develop standardized deployment processes

- Create efficient multi-site service delivery capabilities

- Establish rapid response protocols for security systems

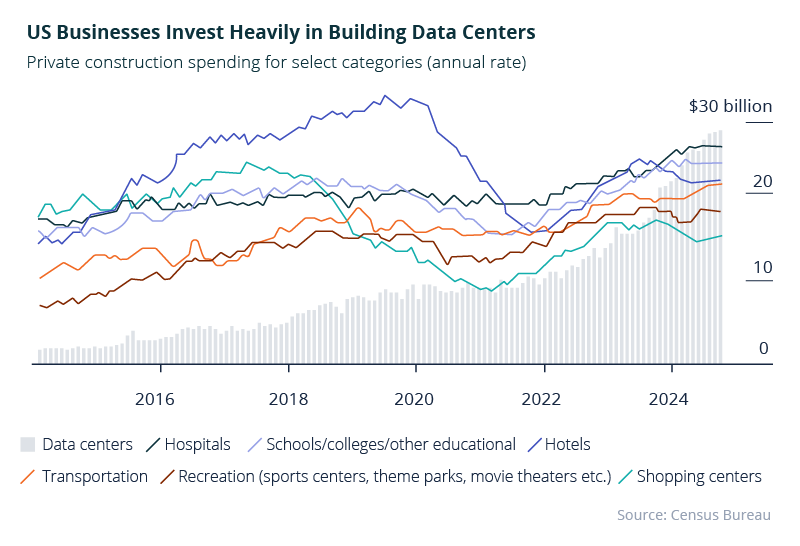

6. AI-driven data center expansion

Data center construction has reached unprecedented levels as artificial intelligence, cloud computing, and big data drive demand for computing power. The global data center construction market, valued at $225.33 billion in 2023, is projected to grow at 7.6% annually through 2030.

Current trends

Market growth

- U.S. data center construction reaches all-time highs

- Expected interest rate reductions could accelerate expansion

- Edge computing drives demand for local data centers

- Cloud adoption fuels infrastructure investments

Infrastructure requirements

- Advanced fiber optic cabling upgrades support increased bandwidth

- Hot-swap capabilities become standard for continuous operations

- Energy-efficient cooling systems address heat management

- Sustainable technologies support green initiatives

Source: Verizon Connect survey of top field service executives

Growing demand for data center expertise requires specialized technical skills and flexible service delivery models. Organizations must manage complex infrastructure requirements while maintaining mission-critical systems. Regular technology refresh cycles create ongoing service opportunities.

Recommended actions

- Develop specialized data center service capabilities

- Build expertise in fiber and cooling infrastructure

- Create efficient deployment and upgrade processes

- Implement a variable workforce model for project work

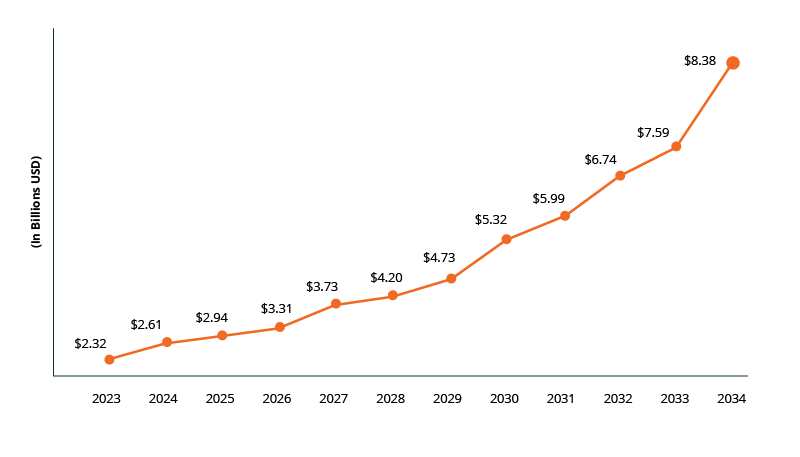

7. The convergence of audio-visual and IT systems

Audiovisual systems are evolving from standalone equipment into network-integrated smart devices, fundamentally changing how organizations deploy and maintain these technologies. This shift demands new technical skills and service delivery approaches. According to Precedence Research, the U.S. videoconference market will reach $8.38 billion by 2034.

Current trends

Enterprise integration

- AV systems transition from isolated installations to network-connected platforms

- Smart device connectivity becomes a standard requirement

- Network dependencies reshape system architecture

- “Room-in-a-box” solutions simplify deployments

Market evolution

- Corporate meeting spaces drive standardization

- Educational facilities upgrade digital capabilities

- Digital signage expands across sectors

- Video wall installations increase in complexity

Traditional AV expertise is giving way to IT-focused skills as installations become more network-centric. Organizations must develop network integration capabilities while shifting from complex AV deployments to standardized IT-based installations. The convergence of AV and IT creates demand for cross-trained technicians.

Recommended actions

- Develop IT networking expertise within AV teams

- Build standardized deployment processes

- Create pools of cross-trained AV technicians

- Align service delivery with IT standards