Hear field service expert Wael Mohammed unpack the factors driving volatile costs and heightened demand across work types, industries, and regions in his recent webinar–now available on-demand.

The Field service industry has been in a state of upheaval for the past two years.

Enormous demand for skilled technical labor is straining against the pressures of a resource-constrained workforce and macroeconomic obstacles. But despite these headwinds, the bottom line remains clear: the field service industry is pivoting and experiencing a massive opportunity, and 2022 will be a key year as the industry steps forward. It is hard to overstate the magnitude of this opportunity.

Within this context, service leaders strive to make smart, data-driven decisions. For many, navigating volatile market conditions and anticipating the on-site service delivery needs of key industries (especially retail) will be the difference between success and failure.

When it comes to understanding these trends, Field Nation’s data provides invaluable insight. In 2021, service companies and technicians completed over one million jobs through the Field Nation platform. This field intelligence allows us to gauge demand signals, spot trends where industries are directing their technology spend, and predict what these trends mean for skilled IT work in 2022 and beyond.

This insight gathers strength as more technicians flock to an on-demand work model. While many service companies struggle to find and retain qualified field service workers, Field Nation adds more than 600 new field service professionals each week. The work these professionals perform is the bedrock of our industry insights.

Field service is evolving due to an unprecedented investment in digitization and wireless/connected devices infrastructure. Field service companies that recognize this and act accordingly will be poised for growth.

In short:

- 2022 will be a boom year for service delivery companies with cross-device experience and the ability to mobilize talent to match volatile demand at increasingly dispersed locations.

- Digitization trends across sectors will accelerate demand for equipment installs and refreshes, especially those related to digitized consumer experience, self-service equipment, connected devices, sensors, technology infrastructure, and digital signage.

- Shifts in talent availability will lead toward more diversified labor sourcing strategies.

The state of field service in 2022

Trends are one thing. Momentous shifts in demand are another. Market data tells us that field service is experiencing a powerful surge in demand, the effects of which are reverberating around the industry.

New data from research firm IHL Group supports what many field service leaders already know: The retail sector is driving the current explosion of opportunity. (Source: IHL Group 2022 Retail Experience Market Summary).

Retail sales are expected to rise 8.8% in 2022. Store counts are expected to increase 2.7%, with a 4.3% increase in remodels. Google searches for “field service technicians” are up by 14% and have reached their highest point in 20 years. Work completed at major companies like Walgreens, Target, and Starbucks have grown relative to last year.

This expansion is coupled with an unprecedented, transformational investment in retail tech – and corresponding IT services. IHL confirms that retail is going through a “once-in-a-generation” technology reset. On average, IT spend as a factor of revenue has increased 40 to 50% since 2019.

“Winning retailers” (i.e. retailers with sales growth of 10% or more) are spending 47% of their IT budget on new systems and innovation. It’s an astounding development: retailers with dramatic sales growth are spending almost half their budget on new systems and innovations. Compare that to just a few years ago when ~80% of their spend was devoted to keeping the lights on with existing systems, with only about 20% left for innovation.

This contrast makes it clear that retailers (and successful retailers, in particular) are adjusting their strategies to succeed in a changing landscape. The past few years have pushed consumers toward hybridized, technologically integrated shopping experiences. Retailers are increasing their IT spend to transform their operations accordingly.

For field service leaders, this once-in-a-generation technology shift represents a remarkable opportunity to take the reins and chase the wealth of new work that is flooding the market.

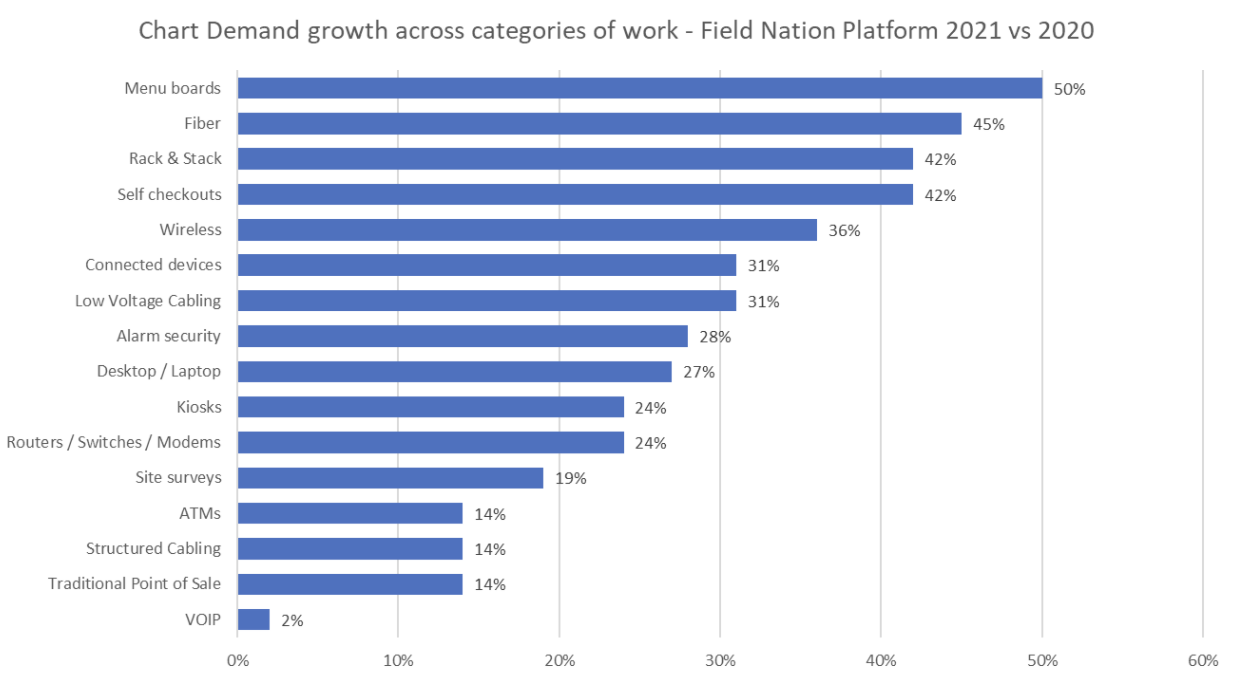

Let’s get into detail. A closer look at Field Nation data from the past year reveals several work-specific trends that service leaders can factor into their 2022 priorities.

The adoption of connected devices is exploding

Wireless work (installing, troubleshooting, surveying, and upgrading wireless access points) grew a whopping 36% YoY in 2021. Connected devices work grew at a comparable rate: 31%.

A significant driver of this trend is ensuring a continuity of experience between brick-and-mortar stores and the corresponding retail websites. Think about the convenience you’ve come to expect from mobile apps and e-commerce hubs. Retailers want to connect that convenience to their in-person shopping experience.

Specifically, in 2020 and 2021, retailers completed a multitude of connected device installations, including beacon devices to connect a shopper’s mobile experience with their store experience, traffic and people counters to keep track of customer numbers, and digitized cameras to analyze heat map traffic and customer experience. The spike in this type of work doesn’t show any signs of abating.

Point of sale and digital signage are growing to keep up with consumer expectations

Demand for work related to self-checkout technology grew an eye-popping 42% YoY in 2021. This effort is related to a unique pain point for society at large: the labor shortage.

Retailers are struggling to attract and retain employees, and they’re trying to keep customer satisfaction levels high despite this obvious challenge. The solution? Self-checkout presents a viable path forward amidst labor uncertainty, and retailers are taking note.

The overwhelming majority of self-checkout growth took the form of installation work. Notably, the opposite is true of traditional point of sale (POS) work, which experienced slower growth at 14% YoY. This type of work was predominantly troubleshooting, maintenance, and upgrades of existing devices, which suggests the beginnings of a gradual shift away from traditional POS devices.

Additionally, digital signage continues to proliferate across industries. While the digitization of stores in particular drove a large number of digital signage installations, we saw digital signage being installed in all sorts of settings (educational, healthcare) and in new use cases such as wait management and visitor guidance. 2021 boasted a 41% YoY growth in digital signage projects, and this trend is likely to continue.

“The increase in devices and upgrades in wireless technology has put tremendous pressure on network infrastructure, resulting in a 42% YoY increase in rack and stack installations and upgrades for all network equipment.”

More devices means more infrastructure

This massive proliferation of devices is also leading to an increase in technology infrastructure installations like low voltage data and voice cables. There was 31% YoY growth in this type of low voltage cable installation work.

Rack and stack work is also growing at an accelerated pace. The increase in device installations and upgrades in wireless technology has put tremendous pressure on network infrastructure, resulting in a 42% YoY increase in rack and stack installations and upgrades for all network equipment.

Desktop/laptop and telecom are experiencing muted growth

While most devices and technologies witnessed above 30% YoY growth, some technologies witnessed less significant growth. This includes desktop/laptop work (driven by in-home technologies associated with work from home (WFH), which grew at 27% YoY.

Telecom also experienced modest growth of only 13%. A majority of these projects happen in corporate settings, which means that the trend toward WFH is likely responsible for this slowdown.

Work is growing across location types (but not in malls and banks)

We are also witnessing a shift in sites where work is taking place. The enduring impact of the pandemic has made different location types more attractive to consumers, while other locations have become less attractive. Below is a summary of location type YoY growth in 2021:

- Quick serve restaurants: +15%

- Retail convenience and pharmacy: + 12%

- Retail general: +5%

- Retail home: +2.5%

- Hospitality: -12%

- Retail department / mall: – 10%

- Banking: -5%

Retail shows several signs of recovery and growth, including a faster pace of store openings than closures and YoY growth relative to 2020. Mass merchants, convenience, pharmacy, and general merchandise are recovering faster, while department stores still lag behind.

Although still charting a path back to normal, the hospitality sector is also making progress. Compare the -12% number above to the devastating -40% drop during the onset of the pandemic. Interestingly enough, there is a self-service aspect to this recovery: many hotel chains are transitioning to self-service check-in and keyless door entry.

It goes to show how connected these technology trends are––and how pervasive the tech reset is across retail and retail-adjacent industries. Companies that take note of this mega-trend and take action will win the future of field service work.

Predictions for 2022 (and beyond)

Here’s the main takeaway: 2022 will produce an unprecedented amount of field service work. For field service leaders, this means a once-in-a-generation opportunity to capitalize on the macroeconomic trends driving technology change at sites nationwide. Organizations with their finger on the pulse and the operational ability to execute have a tremendous opportunity to secure a lot of business. And I mean a lot.

Let’s get specific. Here is a breakdown of some key field service trends to expect in 2022. Plan accordingly and reap the rewards:

- Technology infrastructure work will increase over the next 12 months. As companies invest more in connected devices, we will continue to see a spike in networking work to enable wireless and connected devices, especially in retail.

- Quick serve restaurants (QSRs) will continue to invest heavily in renovation efforts related to outdoor menu boards and pickup lanes. Over 65% of QSR services revenue comes from this channel, making it a clear priority. We saw an increase of over 50% in outdoor menu boards this past year.

- Retailers and restaurants will invest heavily in upgrading to fiber infrastructure. This will support the increase in speed required by modern devices.

- The accelerated adoption of contactless devices across industries (especially self-checkouts and self-order kiosks) will continue. Triggered by the pandemic, growth in contactless device installations continues to accelerate. OEMs have become significantly smarter about this and are manufacturing solutions that align well with the needs of different store types. For example, convenience stores have their own self-checkout format that is different from the grocery format. We witnessed 42% YoY growth in spend on self-checkout technology, especially in grocery and convenience stores.

- The massive proliferation of devices will lead to a sustained increase in the installation of low voltage data and voice cables. We saw 31% YoY growth in low-voltage cable (LVC) installations. This trend will likely continue through 2022 and beyond.

- The heightened number of security device installations will continue. There was a 28% YoY increase in installations of security cameras, CCTV devices, alarms, and door security systems. This trend will continue in 2022.

- Retail growth in the exurbs (population centers 50 to 100 miles outside major urban areas) will persist. This will place greater strain on service companies to provide both project and maintenance services in these areas.

- Lingering labor shortage issues will remain. This will push field service organizations to develop a diversified set of labor channels to meet the geographic reach and required skillsets of the current wave of demand.

The adventure ahead

I mentioned the labor shortage earlier in this report, and I touched on how painful it has been across industries. Field service has not been immune to this pain, and other macroeconomic trends are making the current labor crunch even harder. Supply chain issues and increased material costs have upped the price tag on each field service visit. Pay rates that have been relatively stable over the past 10 years have spiked across the field service industry.

These developments are disorienting and distressing, especially as they coincide with the unprecedented opportunity outlined in this report. From the perspective of a field service leader, it is easy to dwell on these obstacles and despair.

But historic opportunities are always met with the twin force of obstruction. By resolving these challenges, we develop new solutions to new problems and collectively transform difficult conditions into stories of hard-earned success. It’s not a setback; it’s an adventure.

And what a moment for adventure! The technological transformation of the retail industry presents boundless opportunity for service organizations with the right resources and skillsets. New methods of connecting with skilled talent allow service teams to flex their workforce and maximize their reach while minimizing cost. The industry’s headwinds are no match for the innovative solutions at our disposal in 2022 and beyond.

If you are interested in learning more about how Field Nation can help you meet demand, connect with our team for more information about on-demand labor and navigating the changing field service landscape.