Field Intelligence: The recovery continues to show signs of growth

May 13, 2020

Insights posted on 5.13.20

Every week, the Field Nation team tracks various field service metrics across our marketplace. These Field Intelligence metrics provide valuable data about the overall health of the field service industry and insight into market shifts.

This week we’re highlighting three areas: week-over-week work order volume, geographic trends, and notable feedback we’ve heard from customers. We hope that this information helps you navigate the market as the industry begins to ramp back up.

Promising growth begins to take hold

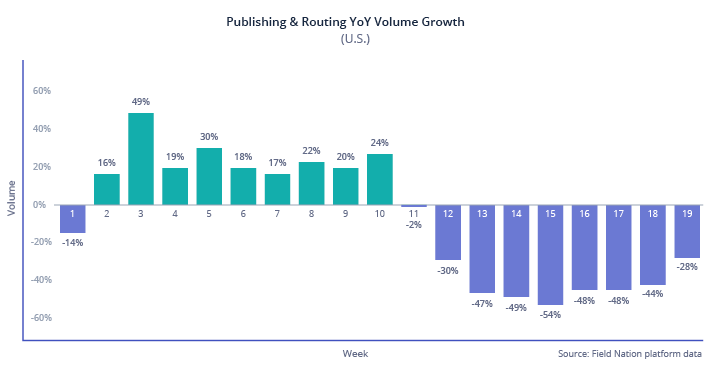

Based on data from our marketplace, week 15 (corresponding to the week of April 6, 2020) was the low point in the market with a 54% year-over-year decrease in work order volume. In week 19 (corresponding to the week of May 4, 2020), we saw a significant increase in activity versus previous weeks.

How will we know if the market is in a state of recovery? As we stated in an earlier Field Intelligence report, our definition of recovery is five to seven weeks of consistent week-over-week growth as well as positive year-over-year growth. Based on the most recent data, it appears that we are at the early stages of a market rebound with signs of accelerating demand. At this point, it is too soon to tell what form the economic rebound will take — a V-shaped,” U-shaped,” or L-shaped” recovery.

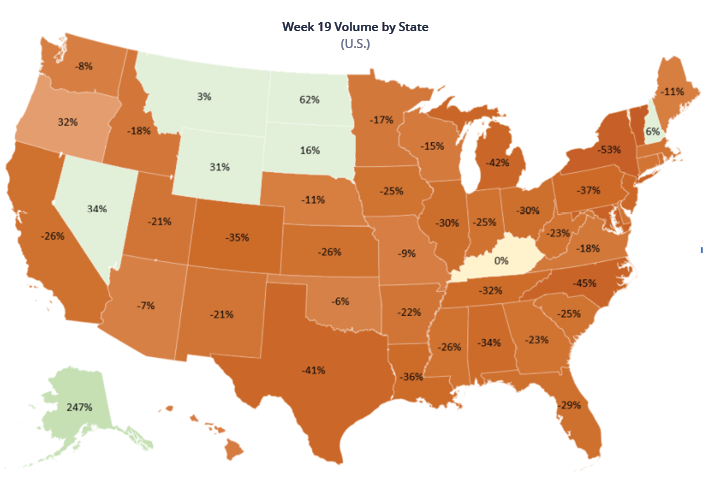

Geographic gains are consistent across the U.S.

Work order volume in all of the U.S. states is trending in a positive direction, although most states are still lagging behind their 2019 levels. Large states including California, Texas, Georgia, Ohio, and Florida have all seen significant upward trends as businesses begin to reopen. However, states that have been more impacted by COVID-19, including New York, are not recovering as quickly.

Insights from Field Nation customers

This week we’ve heard from several customers about how they’re responding to market opportunities.

Ongoing demand from essential businesses

We continue to hear about project work with essential businesses, such as drug stores and grocery stores. The work ranges from IT projects to installing safety equipment, such as sneeze guards. Increasingly, technicians are completing these projects after hours to minimize customer contact.

Continued focus on PPE

More companies are including COVID health and safety guidelines into their project scope. For technicians, having the proper PPE and sanitation supplies to work safely has become critical.

Maximizing productivity with integrations

As companies continue to scrutinize headcount, fewer people are available to manage technicians and work orders. As a result, businesses are looking for new ways to avoid extra steps, particularly data entry. Field Nation customers have found that pre-built or custom field service integrations are a valuable time saver while they operate with a leaner staff.

What does all of this data mean? We believe there’s cause for early optimism. We’re seeing positive signs of growth from large and small clients who are receiving bids for June projects. We’ve also heard that customers anticipate a spike in volume starting in late Q2 and Q3.

As the current situation develops, we’ll continue to bring you Field Intelligence to inform and guide field service industry leaders and businesses.

—

Field Intelligence experts

Wael Mohammed has been in the IT services industry for more than 27 years. He has held leadership roles in both startups and large enterprises, including SPS Commerce, IBM, and Target. Wael is currently the Executive Vice President of Product at Field Nation, and oversees product management, product design, and data science. He is a master in identifying product and market growth opportunities, taking new products to market, and maximizing product performance.

Steve Salmon brings more than 30 years of leadership experience to the IT services industry. He has held senior roles in both startups and large enterprises, even co-founding a technology services company in 1992, which was later purchased. Currently, Steve is the VP of Enterprise and Channel Sales at Field Nation. Previously, he served as SVP of Global Managed Services Solutions at CompuCom, where the services revenue grew from $200M to more than $1B. Steve’s expertise and strategic prowess have landed him on numerous radio shows as a technology and business specialist.

RELATED RESOURCES

More from the field

- Field Service

- Industry Trends

- Field Service

- Product Updates

- Blog

- Best Practices

- Business Growth

- Blog