What history can tell us about recession scenarios

February 13, 2023

According to a recent IDC “State of the Market” report, businesses still aim to maintain IT budgets and growth in 2023, contingent on the mild recession scenario many see as likely. Of course, a more severe downturn could affect IT spending. But how?

Though it happened under a unique set of circumstances, the economic turmoil caused by COVID-19 provided valuable data on which types of field service work are most dramatically affected in a severe economic downturn and how quickly those service types recover.

Field service work took a hit

In March 2020, when the COVID-19 pandemic began in earnest, all types of field service work took a hit. But the intensity and staying power of that hit varied. Infrastructure work involving new store openings and remodels dropped 30-40%. Deployments dropped by 20-30%. Mission-critical equipment work (i.e., break/fix) did not drop at all.

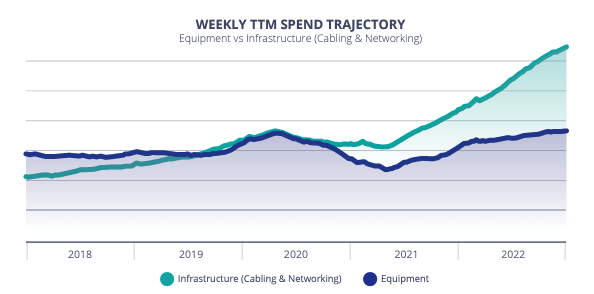

While it took a dramatic hit, infrastructure work recovered more strongly and actually accelerated. Over the past year and a half, infrastructure work has grown 100%. The graph below (which represents the 12-month-trailing spend to give a better sense of the general trajectory) illustrates this trend clearly:

Feeling the pressure to keep up

This variable recovery model aligns with the priorities we see in the retail space. Retailers are pushing to upgrade their cabling and networking infrastructure––even amid economic volatility––because they were feeling the pressure to keep up with changing consumer experience expectations with wireless connectivity and IoT technology.

Understandably, fears of an impending recession weigh heavily on the minds of business leaders across industries. Field service leaders are no exception.

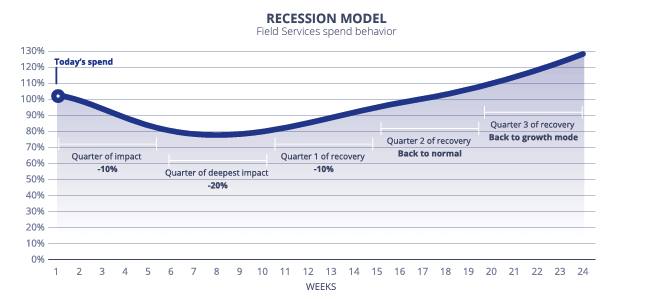

Here’s the bottom line: In a potential recession scenario, we project the same L-shaped recovery described in the previous section. The timeline will likely be compressed into 9-12 months, but it will follow the same general recovery pattern. As you can see, the third quarter of recovery is when we expect field service customer spending behavior to return to growth mode––as high as 20% above current levels.

Get specific about different types of field service

But let’s get a bit more granular. As I mentioned earlier, the field services industry is heterogeneous, which makes it absolutely necessary to get specific about how different service types and related equipment will react in a recession scenario.

For example, break/fix work will react differently than complex projects and deployments. Work involving different equipment types will also respond varyingly.

For more detail on how these different work categories will respond in a recession scenario, download our Definitive guide to field service in 2023.

The economic turmoil caused by COVID-19 provided valuable data on which types of field service work are most dramatically affected in a severe economic downturn and how quickly those service types recover.

ABOUT THE AUTHOR

Wael Mohammed

Wael Mohammed has been in the technology industry for three decades. He has held leadership roles in startups and large enterprises, including SPS Commerce, IBM, and Target. Wael is currently the Executive Vice President of Product Management & Strategy at Field Nation, and oversees strategy, product management, product design, and data science. He is a master in identifying product and market growth opportunities, taking new products to market, and maximizing product performance.

RELATED RESOURCES

More from the field

- Industry Trends

- White Paper

- Industry Trends

- Blog

- Business Growth

- Control Costs

- On-demand Webinar