Field Intelligence: Market recovery on the horizon

June 10, 2020

Insights posted 6.10.20

Our latest Field Intelligence report, based on data from the Field Nation marketplace, builds more evidence of a field service market recovery across the U.S.

Dramatic increase in work volume highlights continued growth

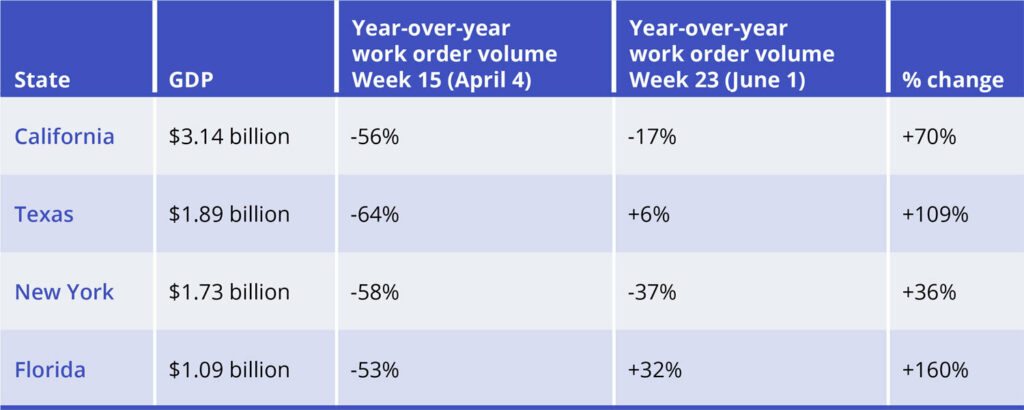

As we stated in an earlier Field Intelligence report, we believe that the low point of the market was in week 15 (the week of April 4), reflecting a broad slowdown caused by retail, restaurant, and other business closures. Since then, we’ve seen a gradual increase in work order volume that has lasted eight weeks.

In week 23 (the week of June 1), we reported a dramatic jump in activity, following week 22, which included the Memorial Day holiday. Marketplace volume was substantially higher than previous weeks and only two percent below 2019 levels. We are seeing strong growth across the board, and in particular, with technology upgrades for retail stores and retail fulfillment providers.

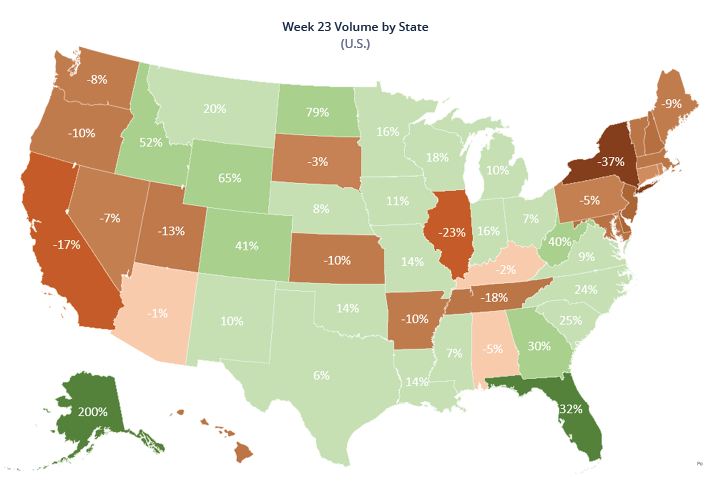

Geographic trends reflect broad expansion

The uptick in field service activity is not limited to just a few states. All 50 U.S. states have dramatically rebounded from their lows in week 15, and nearly half now show positive year-over-year growth.

We’ve been closely tracking activity in the largest states in terms of gross domestic product, and all have shown marked improvements over the past several weeks.

Unsurprisingly, states with lower virus activity and those that re-opened earlier are among the first to recover. However, California, New York, and other states with stricter shutdowns are also rebounding from the market low.

Our definition of a market recovery is five to seven weeks of consistent week-over-week growth as well as positive year-over-year growth. Although the broader U.S. economy has likely been in a recession since February, a recovery appears to be close at hand for contingent field service labor.

Field Intelligence experts

Wael Mohammed has been in the IT services industry for more than 27 years. He has held leadership roles in both startups and large enterprises, including SPS Commerce, IBM, and Target. Wael is currently the Executive Vice President of Product at Field Nation, and oversees product management, product design, and data science. He is a master in identifying product and market growth opportunities, taking new products to market, and maximizing product performance.

Steve Salmon brings more than 30 years of leadership experience to the IT services industry. He has held senior roles in both startups and large enterprises, even co-founding a technology services company in 1992, which was later purchased. Currently, Steve is the VP of Enterprise and Channel Sales at Field Nation. Previously, he served as SVP of Global Managed Services Solutions at CompuCom, where the services revenue grew from $200M to more than $1B. Steve’s expertise and strategic prowess have landed him on numerous radio shows as a technology and business specialist.

RELATED RESOURCES

More from the field

- Product Updates

- Blog

- Best Practices

- Field Service

- Blog

- Field Service

- Industry Trends

- Blog