Contents

- Solving the field service resourcing challenge in retail in-store systems

- Service delivery problems are customer experience problems

- Traditional service delivery labor options have missed the mark

- Bridging the cost/quality dilemma with on-demand labor

- On-demand labor addresses a critical gap in the service delivery labor model

- Optimizing your workforce for maximum effectiveness

- Adding on-demand labor into your service delivery labor model

- Forward-thinking service leaders are poised to deliver it all

Solving the field service resourcing challenge in retail in-store systems

The unprecedented events in 2020 forced service leaders to challenge the status quo or risk obsolescence. Companies that prided themselves on having a best-in-class field service workforce were suddenly caught with an enormous operating expense sitting idle with no end in sight. In contrast, flexible service teams that could meet the retail industry’s demand for contactless technology experienced tremendous upside.

Nowhere was this more prominent than retail store system installs. Retail technology projects are notoriously unpredictable, and 2020 was no exception. An unexpected surge in demand for replacing point-of-sale systems with self-serve, in-store experiences placed enormous pressure on resource-strapped teams. Overnight, multi-year rollouts were suddenly condensed to 90 days.

And service leaders were expected to deliver it all: a price point that won the deal while still improving margins and providing a quality service experience. It was an impossible scenario, and many companies failed to deliver.

This challenge is not a new one. For years, service teams have struggled with how to do install, move, add, and change (IMAC) projects at thousands of retail locations across the country at the lowest possible cost. Some responded with field teams traveling hundreds of miles at a moment’s notice, adding even more cost to the project. Others partnered with subcontractors to increase coverage and agility. But what they gained in agility they lost in control, since they were now removed from the technician selection process. The resulting cost/ quality dilemma placed service leaders in a precarious position. Either give up control of their brand to gain flexibility and coverage and risk the customer experience, or cover the gap with travel and absorb enormous costs.

The resulting cost/ quality dilemma placed service leaders in a precarious position. Either give up control of their brand to gain flexibility and coverage and risk the customer experience, or cover the gap with travel and absorb enormous costs.

Service delivery problems are customer experience problems

89% of customers begin business with a competitor following a poor customer experience. Source: Oracle

Companies that have relegated the cost/quality dilemma to the service delivery organization to solve have done so at their own peril. Not only does service delivery impact the overall profitability of the business, but it also ties directly back to the customer’s satisfaction with the entire partnership. If the services team is missing the mark, it jeopardizes the entire relationship and the company could lose the ability to bid on future projects.

Unfortunately, customer attrition caused by service delivery failures often goes undetected until after the business is lost. A myopic focus on delivering incremental margin improvements often results in a diminished customer experience, an unintended consequence that can have disastrous repercussions on the business.

CUSTOMER STORY

Margin pressure leads to painful tradeoffs

The VP of Service Delivery of a multi-billion-dollar technology provider was under tremendous pressure over significant margin and customer losses. The company had been leveraging subcontractors for years to service rural areas at a more competitive price point.

As he dug deeper, he discovered that the subcontractor relationships were coming at a terrible cost: performance penalties and eroding customer satisfaction. Missed SLAs were costing the company hundreds of thousands of dollars and risked their most important customer relationships.

To exacerbate the issue, the company was grossly underbidding deals to the point that they weren’t profitable. To improve both customer satisfaction and margin, the company fired all of its subcontractors and brought the field service workforce back in-house. As a result, they were forced to drop customers in regions where they couldn’t maintain a direct employee presence.

Traditional service delivery labor options have missed the mark

For years, service leaders have grappled with fulfilling field service demands for projects at hundreds of locations spread across the country. Over time, companies have evolved from supporting geographically dispersed projects with their own staff (full-time employee model) to relying more on vendor partners (outsourced model). When those partners cannot find talent, they collaborate with another vendor partner to fill in the gaps. In some instances, the same job can go through as many as five different providers, further eroding already razor-thin margins.

Besides profitability, companies lose visibility, transparency, and control, creating a lose-lose scenario. Not only do they pay more because so many parties are involved, but they also lack insight into who is representing their brand to their customer.

CUSTOMER STORY

Struggling to reduce costs without sacrificing quality

An SVP of Global Services for a multi-billion-dollar point-of-sale and financial technology OEM was under tremendous pressure to cut costs even further on already lean margins. His teams had scraped for every incremental improvement they could find, but they were still failing to deliver. That failure was costing more than just margin points. Sales was losing more of their bids due to price, costing the business millions in lost revenue. The SVP needed to reduce delivery costs without sacrificing quality to do it.

The problem was a tough one to solve. For the company, the service delivery organization was considered a necessary evil. Product sales were the lifeblood of the business and added all the incremental value. The services team needed to operate behind the scenes to ensure those products were installed and maintained on time, on budget, and without incidents. And each year, they were expected to do all of this more profitably and with fewer resources. It was a model that had worked for years but was now under fire. With service delivery costs stagnant, the company struggled to offer a competitive bid that was also profitable. It needed to find ways to make up the difference.

Bridging the cost/quality dilemma with on-demand labor

In the past several years, the field service industry has moved beyond the traditional full-time employee and outsourced models. The modern approach to on-site services staffing has evolved toward using a blend of full-time, outsourced, and contingent labor. This trend takes advantage of the growing number of self-employed technicians that organizations use to complement their full-time employee base and subcontractor partnerships.

To access contingent talent, more companies are turning to platforms that allow them to source and deploy talent on demand. On-demand access to talent combines the coverage and variability of the subcontractor model with the technician selection, control, transparency, and management favored in the employee model. Used by both OEMs and third-parties, the on-demand talent model gives companies more control over the quality of delivery while allowing them to reduce costs, typically by 30 to 40 percent over full-time workers.

Used by both OEMs and thirdparties, the on-demand talent model gives companies more control over the quality of delivery while allowing them to reduce costs, typically by 30 to 40 percent over full-time workers.

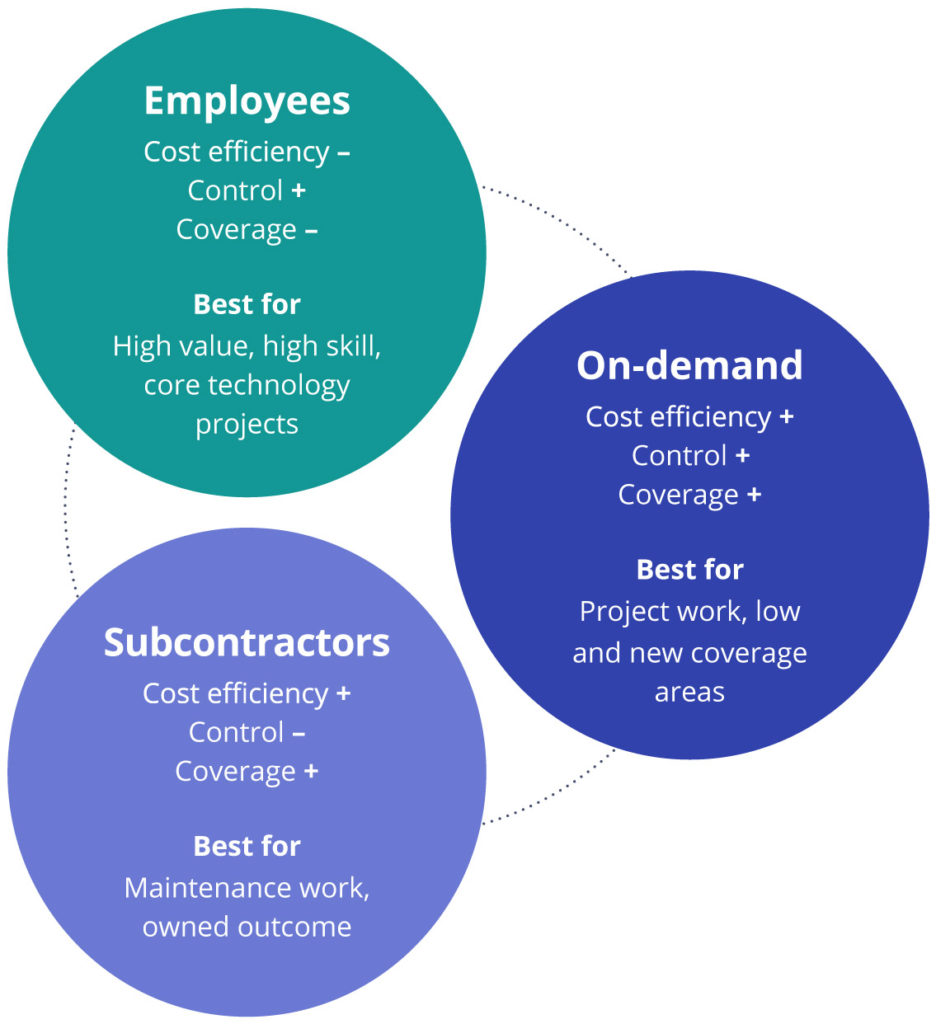

On-demand labor addresses a critical gap in the service delivery labor model

The traditional employee and subcontractor models are at opposing ends of the spectrum, resulting in trade-offs between coverage, cost, and control. By incorporating on-demand resources into the labor mix, companies can bridge that gap with flexible, local resources while also having visibility and control of the technician selection process. The result is a blended workforce model that aligns each option’s strengths with the complexity, variability, and location of the work. For the first time, service leaders are in a position to deliver it all: a competitive price point at a profitable margin delivered with a high quality of service.

Optimizing your workforce for maximum effectiveness

Savvy service leaders optimize their labor mix by aligning their employee resources with the highest value and most predictable tickets. As the work variability increases, companies can shift their focus from employees to variable workforce options, including subcontractors and on-demand talent. Using flexible options for less predictable work, companies can reduce their team’s bench time and dedicate more of their resources to higher revenue tickets that directly align with the company’s core competencies.

In deciding whether to use subcontractors or on-demand labor, leaders need to assess their dispatching and management capacity against the need to have direct access to resources at a lower price point. Often, companies use subcontractors for low-value, maintenance work that requires management to an SLA or when the company’s dispatch capacity also needs to flex to match demand.

On-demand labor is the preferred solution for highly variable work when a company does not have an employee within thirty minutes of the site and needs to have control of the technician selection process. Resource visibility and vetting are essential in retail, as technicians are often interacting with the retailer’s customers.

Adding on-demand labor into your service delivery labor model

Over the past dozen years, Field Nation has worked with hundreds of service companies in the retail industry to incorporate on-demand labor into their blended workforce model. Here are the three steps they have followed to achieve success.

STEP 1: Validate

Scope: One project, one region

Timeline: 1-3 months

Tickets per day: 10+

The validation step is where you establish technician selection criteria and create the materials needed to promote and manage work on the platform. We recommend choosing one geographic region for one project to start. Often, companies will select a region where they have struggled to resource talent for previous projects.

A critical component of the validation step is establishing parameters to measure the effectiveness of the engagement upfront. Common examples include average price per ticket, first-time resolution, and customer satisfaction ratings.

STEP 2: Adopt

Scope: One project, nationwide

Timeline: 3-6 months

Tickets per day: 50+

Once you’ve validated that the on-demand model can work alongside your other types of labor, we recommend scaling to additional geographic regions across the U.S. and Canada for a single project.

STEP 3: Scale

Scope: Multiple projects, nationwide

Timeline: 6-9 months

Tickets per day: 100+

Once you are confident that the on-demand model works well for multiple locations for a single project, you’re ready to scale to multiple projects. Upon reaching this milestone, we recommend integrating an on-demand labor solution with your field service management software to reduce redundant data entry.

Forward-thinking service leaders are poised to deliver it all

2020 brought unprecedented change and, with it, some upside. The sudden and unexpected shift in retail technology installs forced companies to rethink how they serviced their retail customers. Organizations that failed to adopt modern delivery methods found themselves unable to adjust to market forces, giving way to agile organizations that supported retail customers as they faced the unexpected. By incorporating on-demand talent into a blended workforce model, these companies found a way to bridge the employee and outsourcing models’ benefits, allowing them to optimize their workforce to maximize all the labor options at their disposal. With the model in place to align the right technician to the right job at the right time, service leaders are now capable of delivering on revenue, profitability, and customer satisfaction across their portfolio of retail customers.