Contents

- 1. Networking shows staying power

- 2. Point-of-sale slowly recovering

- 3. Telecom/VOIP accelerates

- 4. Desktop/laptop category shifts to support virtual work

- 5. Digital signage poised for growth

- 6. Low-voltage cabling is slow, but steady

- 7. ATM work experiences rapid surge

- 8. CCTV/alarm category remains robust

- Other trends we’re seeing

- Want more insights into field service trends?

Uncovering 8 critical insights into the recovery of field service work

April 21, 2021

What types of field service work are recovering the fastest? Where are the most opportunities for growth? We’re glad you asked!

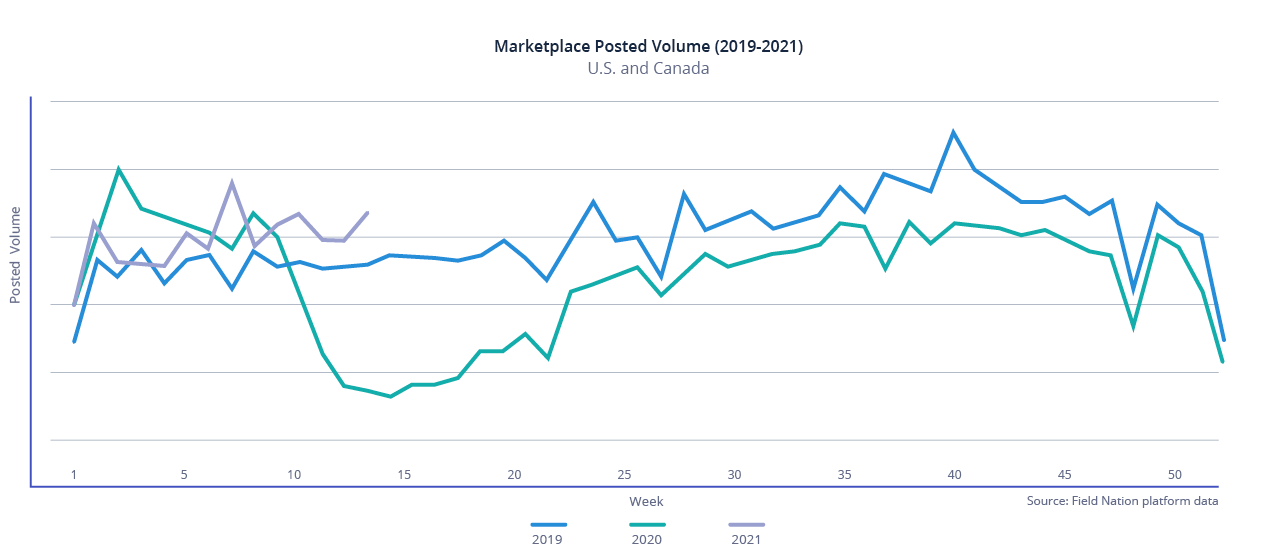

In our latest Field Intelligence report, we take a deep dive into data from the Field Nation marketplace. Due to the volatility in 2020, we are comparing our 2021 marketplace data to pre-pandemic levels. Overall, the volume of work transacted on the Field Nation in Q1 2021 is approximately 3 percent higher than in Q1 2019.

Some types of field service work recovered almost immediately after the initial “market shock” from the global pandemic, while other types have been slower to rebound.

Read on for more insight into these trends.

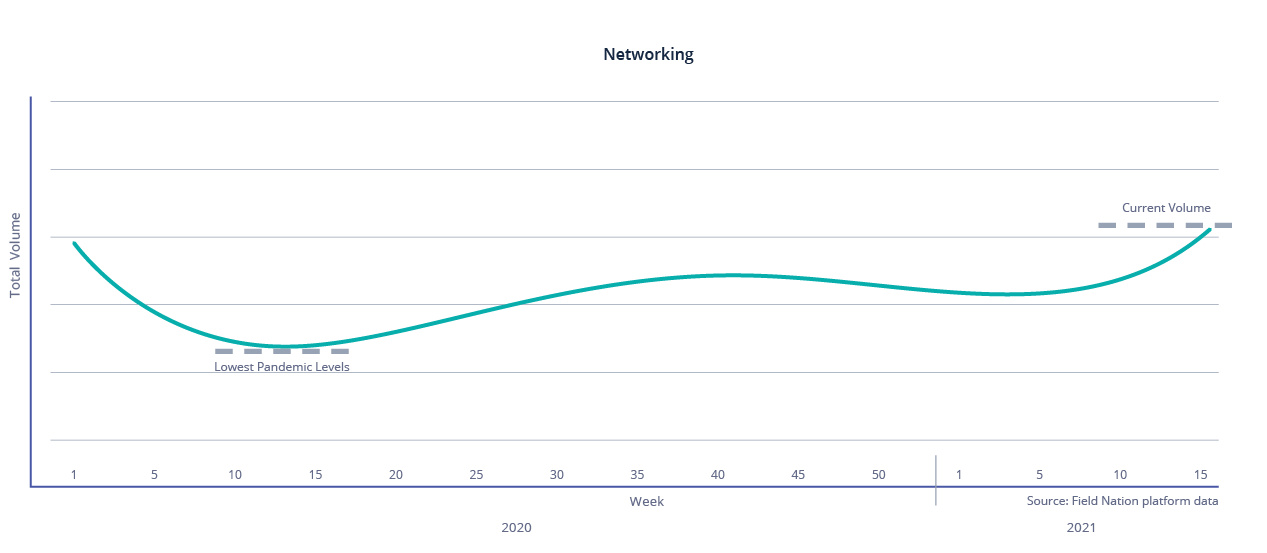

1. Networking shows staying power

The pandemic forced businesses to reconsider their requirements for networking technologies. The unprecedented number of employees working from home created the need for reliable and secure connections into remote servers. As a result, many businesses expanded their network infrastructure.

Activity on the Field Nation marketplace is consistent with these trends. After an initial decline in the early months of the pandemic, networking volume in Q1 2021 was 4.3% above pre-pandemic levels. We believe the growth in this sector will persist long after the pandemic has ended.

2. Point-of-sale slowly recovering

Contactless transactions were gaining momentum prior to the pandemic, and their growth has accelerated. As a result of changing consumer preferences, the form factor of point-of-sale (POS) systems is changing. Initially, many retailers paused investing in traditional POS systems in favor of self-checkout (SCO). Eventually, we believe checkout will move onto the consumer device (i.e., phone), which will continue to affect the POS hardware category.

On the Field Nation network, point-of-sale work is currently 1.7 percent above 2019 volume but remains below Q1 2020 levels. However, modest increases are beginning to occur due to planned POS sanitation projects, and we foresee drastic increases coming related to SCO projects.

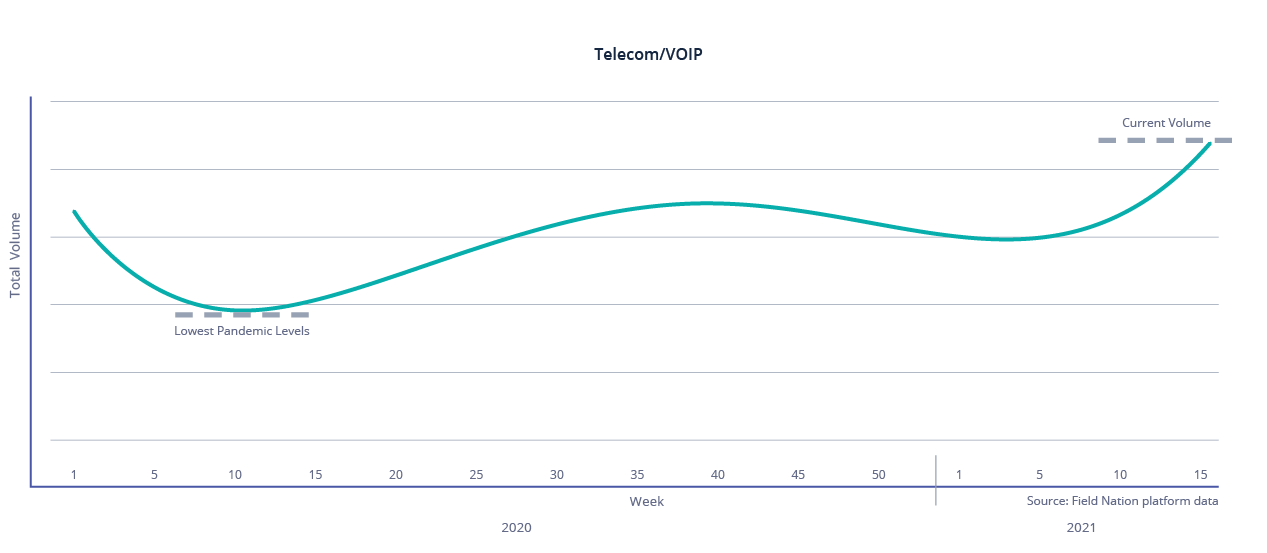

3. Telecom/VOIP accelerates

Demand in telecommunications and voice-over-IP (VoIP) is growing dramatically. The rise of remote work and an increasing reliance on digital devices are key drivers in this category. After the initial slowdown caused by the pandemic, companies continued to face pressure to upgrade Internet bandwidth. Not surprisingly, we are seeing growth in this category of 22.9 percent over Q1 2020. In 2021 and beyond, we expect to see increasing 5G adoption and growth in unified communication as a service (UCaaS).

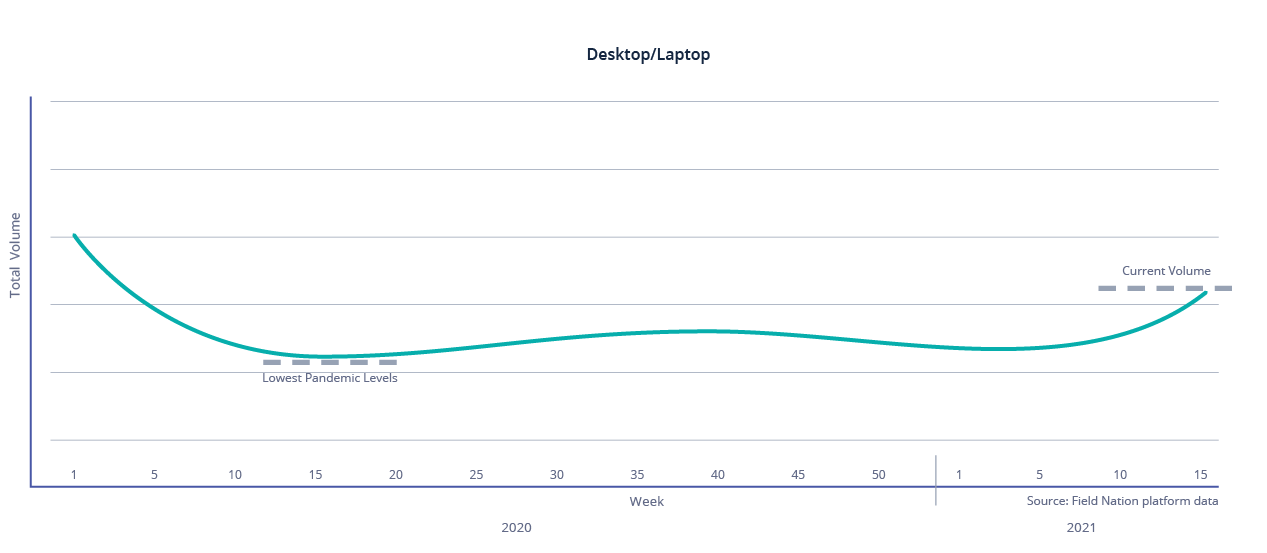

4. Desktop/laptop category shifts to support virtual work

Corporate offices are working virtually, which has affected the desktop/laptop category. This sector has decreased by 25% since the first quarter of 2020.

Even as some workers return to their offices, virtual and hybrid work continues. With more workers at home, we are seeing increasing demand for installing and repairing desktops and laptops used in home offices. In the long run, managed service providers will need to develop a strategy for supporting workers in their offices and in their homes.

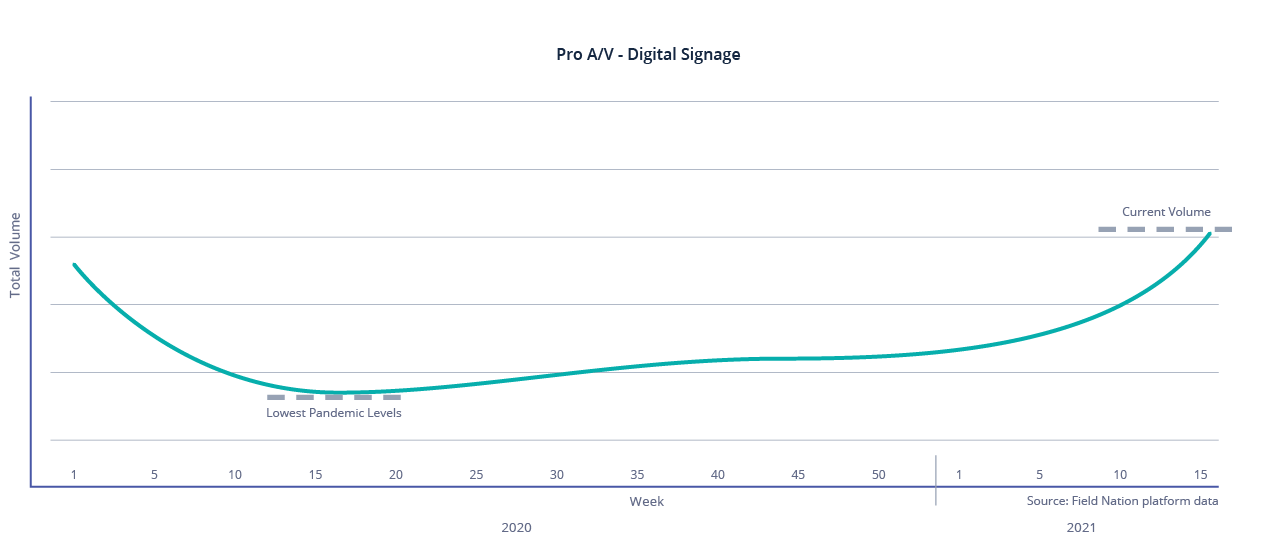

5. Digital signage poised for growth

Digital signage experienced an initial slowdown but has rebounded sharply. Work order activity on our network is now on par with pre-pandemic levels.

Quick service restaurants (QSRs) are upgrading their digital signage and outdoor menu boards. Also, many types of retail stores, including pharmacies, convenience, and grocery stores are investing in digital signage. We expect digital signage to continue to replace traditional signboards as businesses strive to bring personalized, interactive messages to their customers.

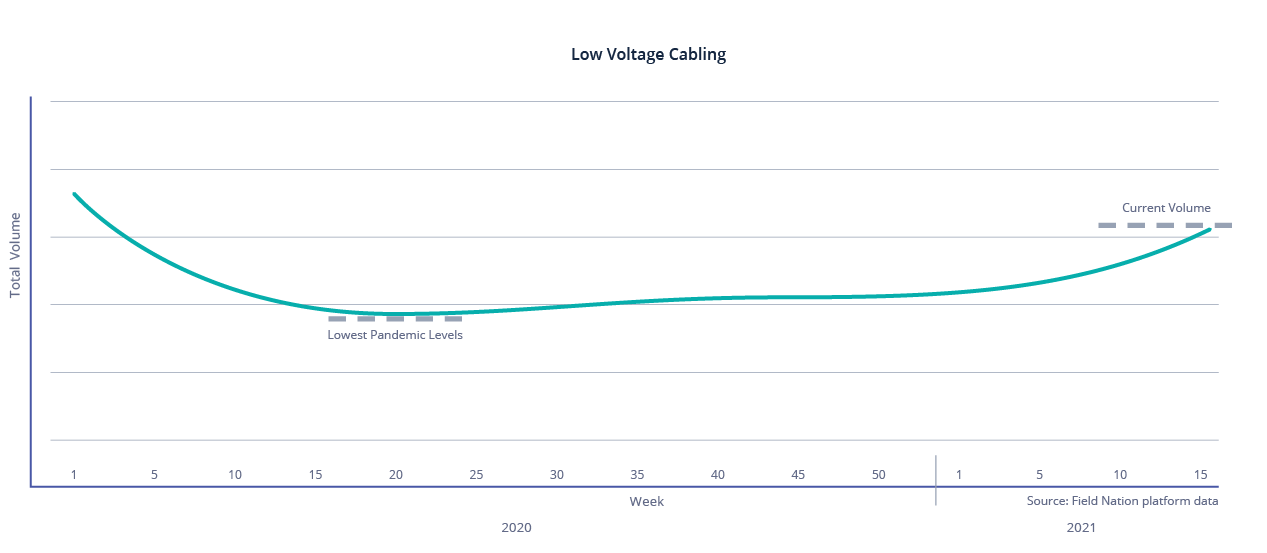

6. Low-voltage cabling is slow, but steady

Low-voltage cabling work took a sudden dip during the pandemic. This category has not fully recovered but is rising steadily. It currently remains 15% below pre-pandemic levels.

This type of work is necessary for most connected devices and companies that service them. So, we anticipate that low-voltage cabling will continue its steady rise.

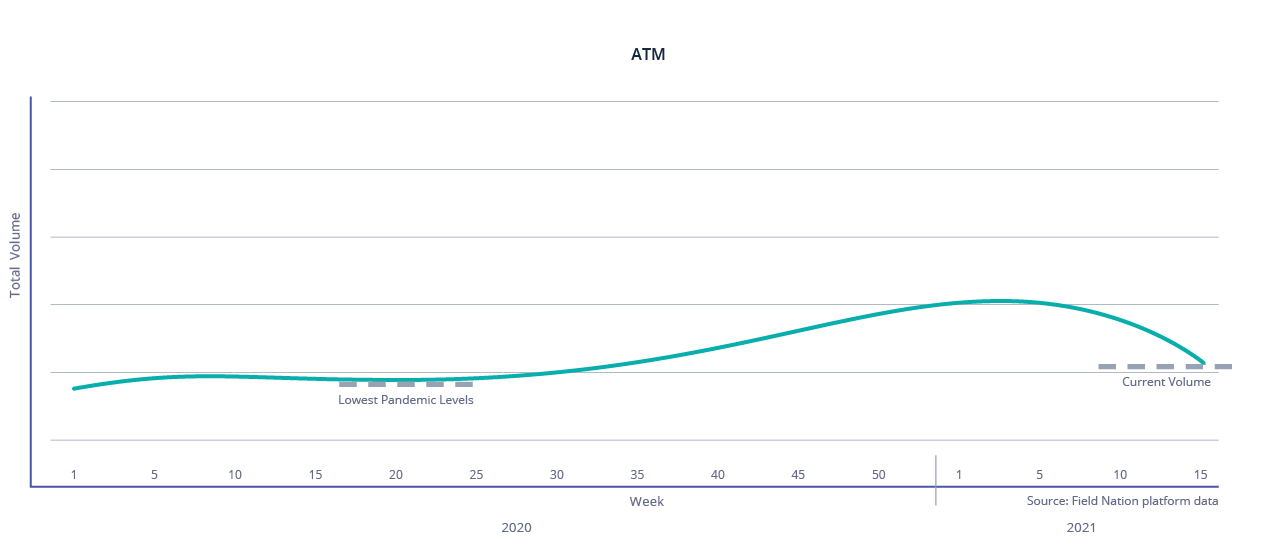

7. ATM work experiences rapid surge

ATM-related work is a bit of an outlier among work types. It did not experience a rapid drop, but rather has continued an upward trajectory.

This recovery is related to sanitizing ATMs regularly rather than fixing technical issues with these devices.

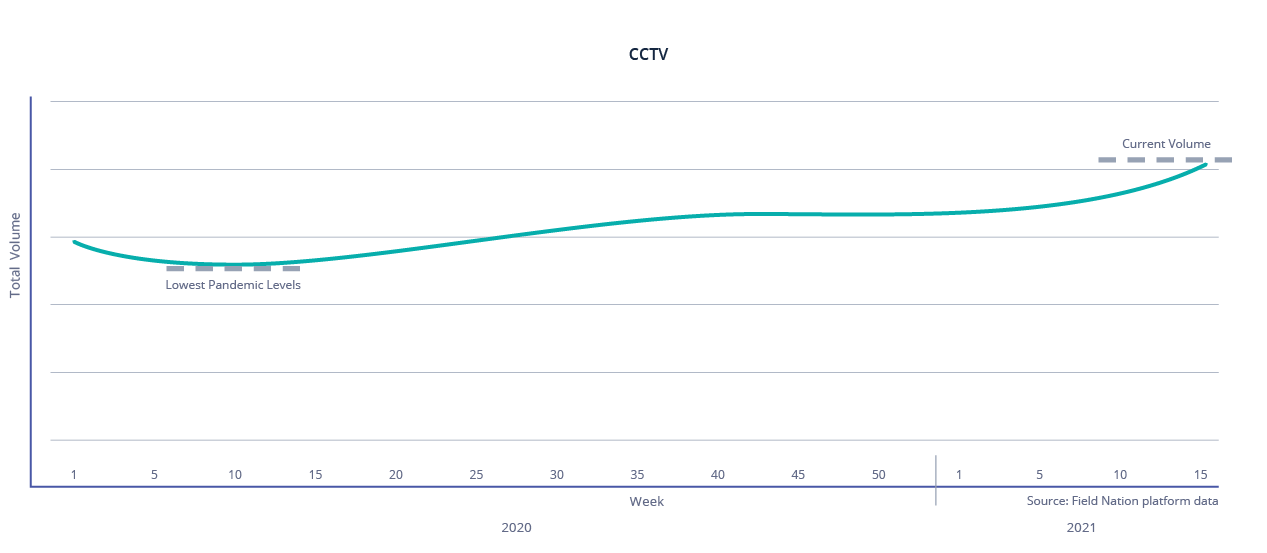

8. CCTV/alarm category remains robust

CCTV and alarm work had a slight dip at the start of the pandemic. However, this type of work is needed even when offices are closed to protect company assets. Also, unrest throughout the country may have contributed to the growth in this category. Overall, this work type is 27% above pre-pandemic levels and showing continued momentum.

Other trends we’re seeing

- According to NRF, retail sales will grow between 6.5 and 8.2 percent in 2021, which would be the fastest growth since 2004. Many consumers are “revenge shopping” to make up for lost time during the pandemic with an increase in spending.

- Retailers are seizing the momentum of the recovering economy. For the first time in years, they are opening more stores than they are closing. According to Coresight Research, retailers plan 3,199 store openings this year.

- The coming months are critical for retailers as shoppers return to stores. Big-box stores, grocers and other retailers are investing heavily to upgrade their customer experience. For example, Walmart is revamping 1,200 stores by the end of the fiscal year. Also, Choice Market recently opened a 5,000-square-foot flagship store in Denver featuring a new “frictionless” shopping experience.

Want more insights into field service trends?

Watch our latest webinars featuring our EVP of Product Management, Wael Mohammed, as he walks through our latest data, and insights on how to prepare for an upcoming surge in work. You can also talk to our expert team to learn more about how to align your business with growth opportunities.

ABOUT THE AUTHOR

Wael Mohammed

Wael Mohammed has been in the technology industry for three decades. He has held leadership roles in startups and large enterprises, including SPS Commerce, IBM, and Target. Wael is currently the Executive Vice President of Product Management & Strategy at Field Nation, and oversees strategy, product management, product design, and data science. He is a master in identifying product and market growth opportunities, taking new products to market, and maximizing product performance.

ABOUT THE AUTHOR

Steve Salmon

Industry veteran, Steve Salmon, brings more than 30 years of leadership experience to the IT services industry. Steve has held senior roles in both startups and large enterprises, even cofounding a technology services company in 1992, which was later purchased.

Currently, Steve is the VP of Enterprise and Channel Sales at Field Nation, a marketplace that connects businesses with skilled technicians. Previously, he served as SVP of Global Managed Services Solutions at CompuCom, where the services revenue grew from $200M to more than $1B. Steve’s expertise and strategic prowess have landed him on numerous radio shows as a technology and business specialist.

RELATED RESOURCES

More from the field

- Field Service

- Industry Trends

- Field Service

- Product Updates

- Blog

- Best Practices

- Business Growth

- Blog