Field services market shows signs of stability

August 14, 2020

Insights posted 8.14.20

After several weeks of volatility, trends appear to be stabilizing across the Field Nation marketplace.

In this week’s Field Intelligence report, we’ll take a closer look at marketplace volume and geographic shifts. We’ll also review cancellation data and trends.

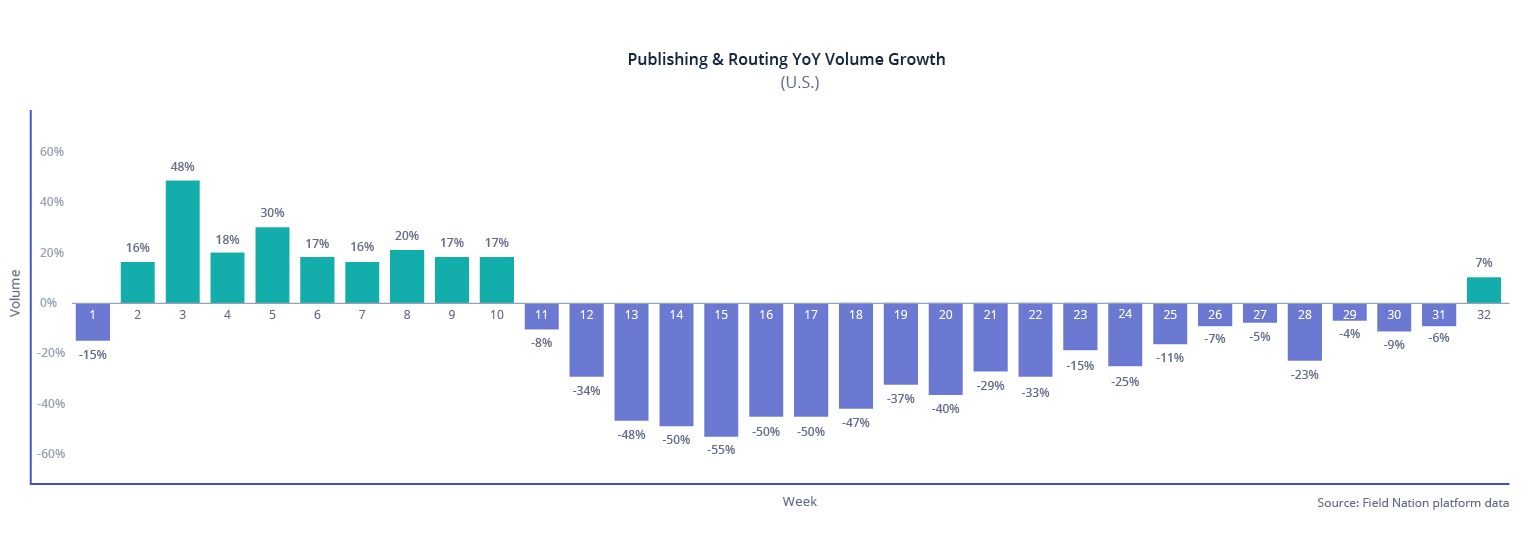

Work volume approaches 2019 levels

Based on the most recent data from the Field Nation marketplace, work order volume appears steady.

In an earlier Field Intelligence report, we described the impact of state closures in response to virus resurgence. These closures may have caused the temporary volatility we saw in week 28 (the week of July 13). Despite some weekly fluctuations, current volume appears to be settling between 5 to 10 percent below 2019 levels.

Favorable geographic trends continue

Key states continued the pattern of recovery that we reported in previous Field Intelligence posts.

Nearly all states have rebounded significantly from the market low. Here are some notable trends:

- Florida has recovered to within 10 percent of 2019 levels

- New York is five percent below 2019 levels

- California is at equal volume to 2019

- Texas is showing positive year-over-year growth of 4 percent

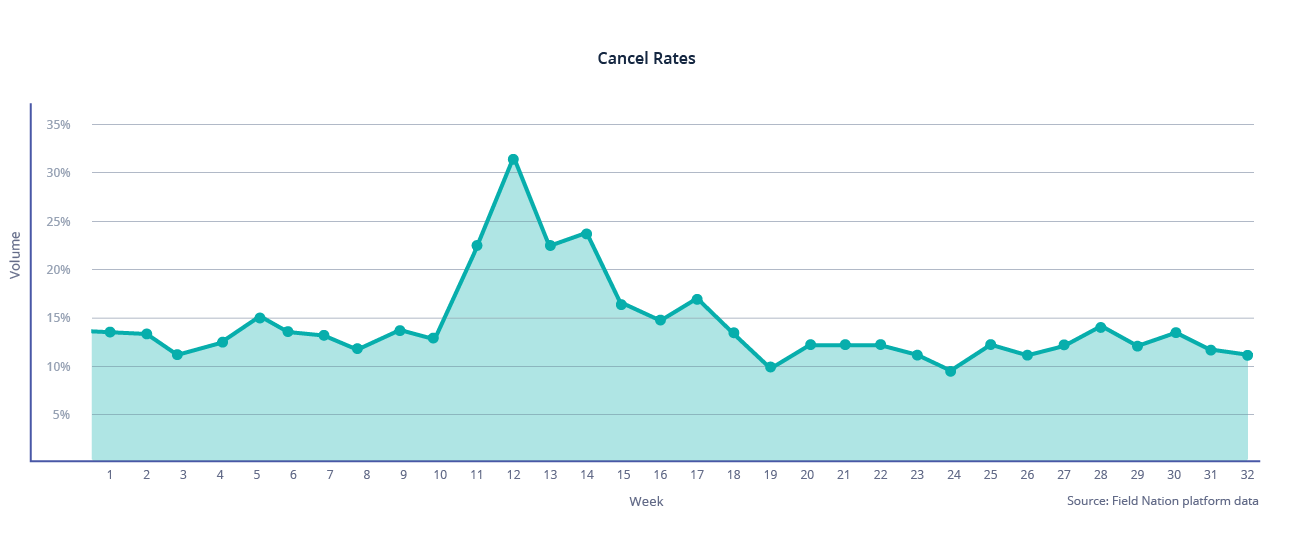

Cancellations remain stable

In week 32 (the week of August 10), we posted a 7 percent increase in year-over-year work order volume. But this number will likely change as cancellations occur.

Our Field Intelligence reporting shares data on posted volume as a leading indicator, but then we adjust for cancellations. That’s why you may notice the data shift over time.

The good news is that cancellations have stabilized between 12 to 14 percent of work order volume. This is not significantly different from what we have seen in prior years.

Work order cancellations happen for a variety of reasons. Approximately 40 to 50 percent of cancellations occur when an end client cancels the project.

Other common reasons for cancellations include:

- Changes in work scope

- Delays at a job site

- The job was completed internally

What’s next for field service?

In typical years, we see a seasonal volume uptick between August and October. Retailers often plan store refreshes and other investments that drive higher volume during this time period. Early indications point to a positive seasonal effect, but perhaps not to the extent of previous years.

Stay tuned for more news on seasonal trends and their impact. We’ll provide additional updates as preparation for the holiday season unfolds.

Field Intelligence experts

Wael Mohammed has been in the IT services industry for more than 27 years. He has held leadership roles in both startups and large enterprises, including SPS Commerce, IBM, and Target. Wael is currently the Executive Vice President of Product at Field Nation, and oversees product management, product design, and data science. He is a master in identifying product and market growth opportunities, taking new products to market, and maximizing product performance.

Steve Salmon brings more than 30 years of leadership experience to the IT services industry. He has held senior roles in both startups and large enterprises, even co-founding a technology services company in 1992, which was later purchased. Currently, Steve is the VP of Enterprise and Channel Sales at Field Nation. Previously, he served as SVP of Global Managed Services Solutions at CompuCom, where the services revenue grew from $200M to more than $1B. Steve’s expertise and strategic prowess have landed him on numerous radio shows as a technology and business specialist.

RELATED RESOURCES

More from the field

- Field Service

- Industry Trends

- Blog

- Field Service

- Industry Trends

- Blog