Cost matters––to field technicians and service delivery companies alike. For service leaders, getting work done at an optimal price point is of the utmost importance.

But rates are subject to market conditions, and this can be a double-edged sword. Over the past year, technical resource costs in the field services space have risen roughly 10 percent across the board. Specifically, market conditions are impacting field service’s bottom line across three dimensions: travel, labor, and equipment costs.

Understandably, this is a painful development for managed service providers that depend on skilled labor to provide core offerings. What are the factors behind this upward trend? How is it distributed among different types of work? How can field service organizations understand and manage costs in this environment?

This report will answer these questions. By analyzing industry data alongside broader market insights, we hope to empower field service leaders with information they can leverage as they plot a route forward through this period of unprecedented field service opportunity.

In short:

- Generally speaking, field service costs are up 8%, with some variance based on type of work and service-level agreement turnaround. Market conditions are driving this increase when it comes to travel, labor, and equipment costs

- Three dominant factors are pushing technical labor rates up: inflation, the great technology reset in retail, and a labor shortage in the field services space.

Understanding the increase in rates

The cost of labor is rising across industries. According to the US Department of Labor, the average wages of private sector workers increased by 5% over the course of 2021. This effect is more pronounced in certain industries, and it is relatively high in the information technology space. In 2021, the wage growth for IT workers who switched jobs was 12.2%.

This number aligns with what is happening in the field service space, where labor costs have risen about 8% YoY.¹

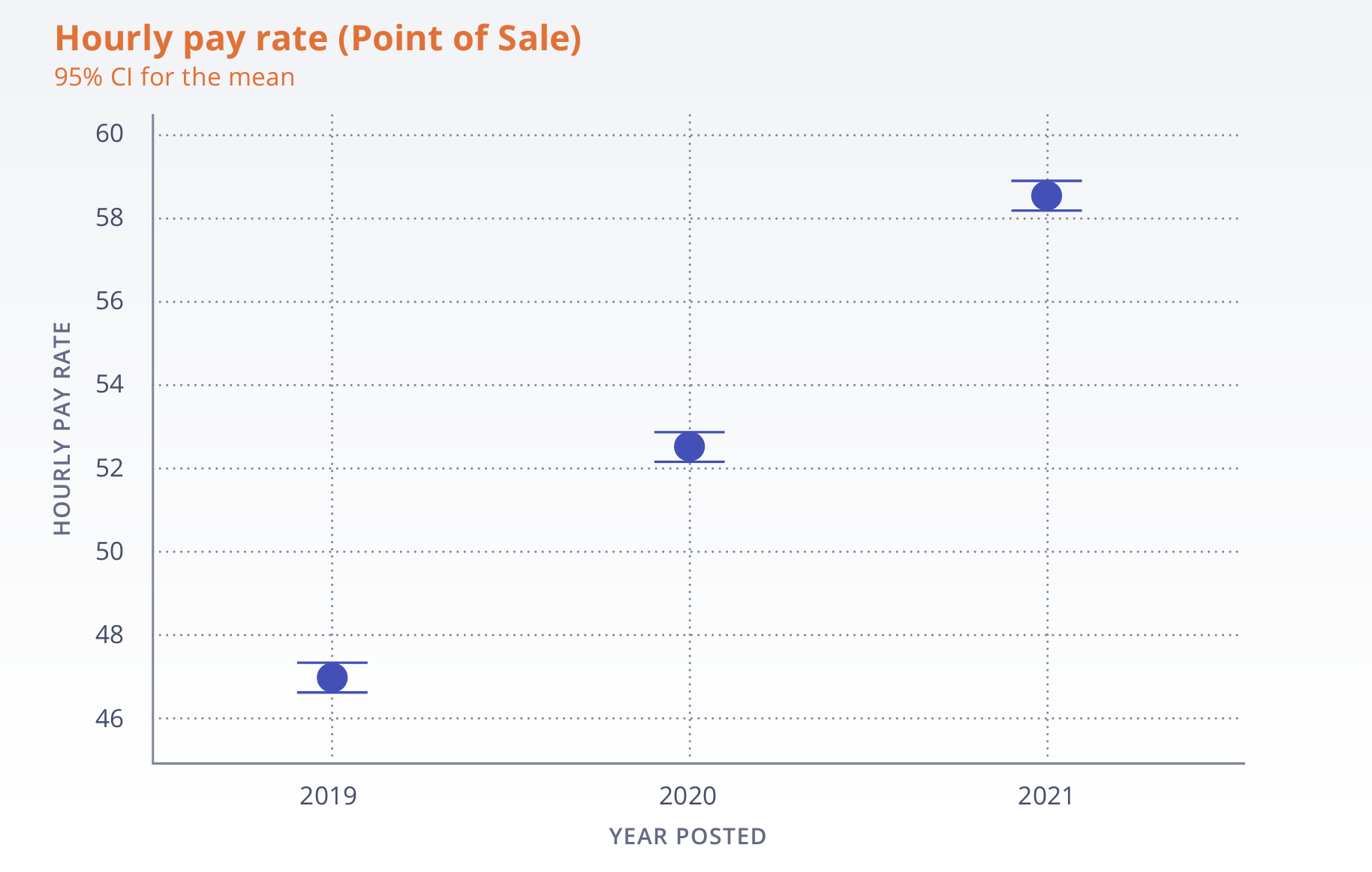

Taking a closer look at this data allows us to 1) put this upward trend into more concrete terms and 2) understand how pay rate increases vary between different types of work.

For example, in 2021 point of sale work costs experienced the steepest jump of any individual type of field service work. The average hourly rate rose to ~$58/hour, up from $52 per hour in 2020 and $47 in 2019.

Networking and low voltage cabling are experiencing similarly dramatic rises (12% and 16%, respectively), while digital signage (5%) and connected devices (6%) are experiencing more muted but still notable pay rate increases.

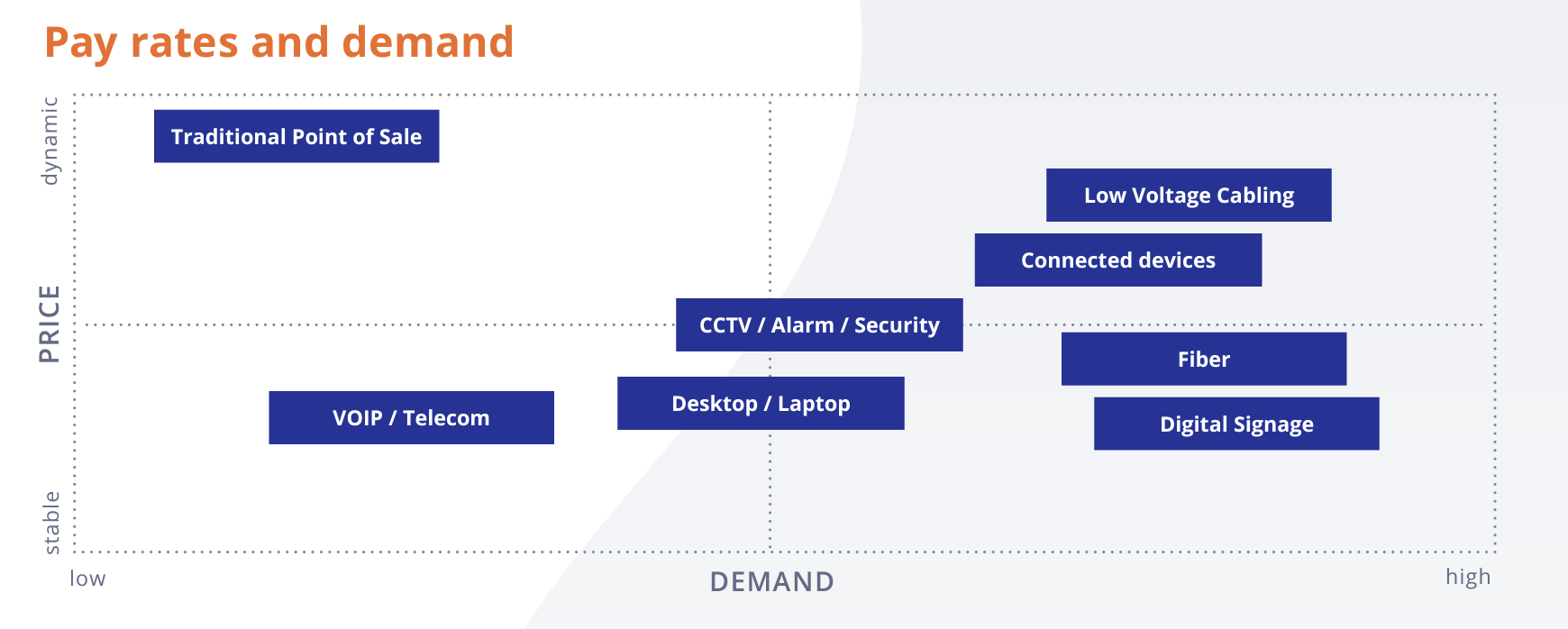

What explains the variance in these increases? For one thing, variable demand. This graph shows the relationship between increasing pay rates and increased demand:

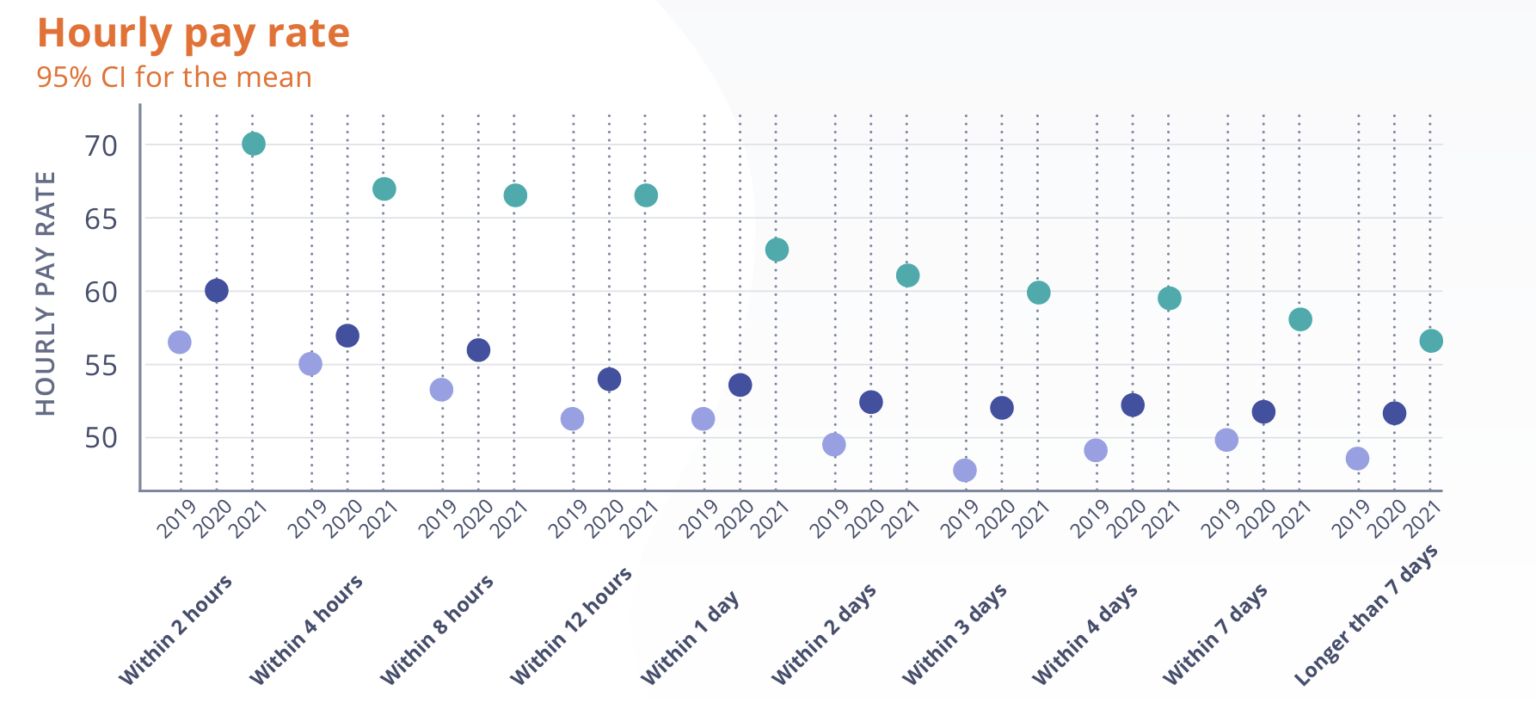

High demand for these services is playing a role in this increase, but the dramatic rise is also being driven by the fact that much of this work is maintenance-driven and therefore comes with a stringent service-level agreement (SLA). There is an inverse relationship between the length of an SLA and the corresponding pay rate. As the SLA responsiveness window tightens, pay rate goes up.

But what is behind this heightened demand in the first place? And what other factors are responsible for pushing pay rates up?

We’ve broken it down into three key factors: inflation, the great technology retail reset, and a labor shortage in the field services space.

1. Inflation

If you’ve so much as glanced at the news recently, you’re aware that inflation levels in the United States have reached their highest levels since 1982. The current annual inflation rate is hovering around 7.5%, with the possibility of rising further.

This impacts nearly every dimension of field service. Gas costs are up 40% YoY, making it more expensive for field techs to get from worksite to worksite. Overall costs related to travel have increased by 6%.

Rising equipment costs are also increasing the price tag on each individual job. Overall equipment costs are up 18%, which impacts the cost of all types of work: cabling, printer, CCTV/alarms, pro A/V, digital signage, and more.

Accordingly, field service rates, which had been relatively stable for the previous ten years, have spiked by 8%. This percentage aligns with the increase in labor rates we are witnessing across industries and in the US market, which tells us something important: The increase in rates in the field service space is being driven more by inflation and macroeconomic trends than heightened demand for particular work types.

Still, there are demand-side factors to consider.

2. The great technology reset in retail

Rate increases are also at least partially attributable to the once-in-a-generation technology refresh currently underway in retail.

The pandemic put pressure on retailers to support multiple modalities (in-store, BOPIS, online, etc.) to appeal to different buying preferences. Retailers want to provide continuity between brick-and-mortar stores and corresponding retail websites, which means increased demand for connected devices. Lingering labor shortage issues have sped up the industry’s adoption of self-checkout technology, which means more demand for point of sale work. This massive proliferation of devices means higher demand for technology infrastructure installations like low voltage data and voice cables.

Retailers are thinking expansively about the technological future of their operations. A recent IHL report shows that “winning retailers” (i.e. retailers with sales growth of 10% or more) are spending 47% of their IT budget on new systems and innovation.²

These companies are increasing their IT spend to transform their business and keep up with consumer expectations. A notable statistic drives this point home: the number of site survey jobs increased 19% YoY in 2021.

3. The field service workforce is changing

The field service industry rests on the expertise of seasoned professionals. In the context of a labor shortage, this is a mixed blessing.

46% of field engineers are 50+ years old, having joined the industry alongside the technology investments of the 1990s.³ This means that a potential labor shortage was already looming over the field service industry.

Furthermore, the labor shortage has had a paradigm-shifting impact on entry-level work in general. Entry-level field service opportunities are competing for talent with numerous other industries affected by wage inflation. Because those roles often don’t require the same level of travel or technical expertise, people just entering the workforce tend to gravitate toward other types of work. Attracting young professionals to the field service space will be a central concern in years to come.

Retaining technicians will also be key. Burnout is causing many to quit, change careers, or hesitate before reentering the field service workforce. According to The Service Council, 60% of field service engineers aged 26-40 aren’t sure they’re going to stay in the profession.

In conjunction with the heightened demand, these supply-side issues are pushing the price of labor up.

Looking forward

Market conditions are driving up field resource costs in three key areas: travel, labor, and equipment costs. In conjunction with demand from the retail sector and supply-side considerations from the workforce, these trends leave field service leaders with the difficult task of protecting margins amidst competing market forces. It will be more important than ever to take a hard look at operations and make judicious decisions around cost-effectiveness and coverage.

¹ Field Nation platform data

² IHL Group 2022 Retail Experience Market Survey

³ TSIA