Volume growth and volatility continue

July 24, 2020

Insights posted 7.24.20

Our latest Field Intelligence report shows continued improvement in market conditions, despite ongoing volatility.

During week 29 (the week of July 20), the upward trend in overall work volume continued. We also see favorable geographic trends, with nearly 80 percent of U.S. states posting year-over-year growth. Finally, our marketplace data indicates a rise in activity across an increasing number of companies.

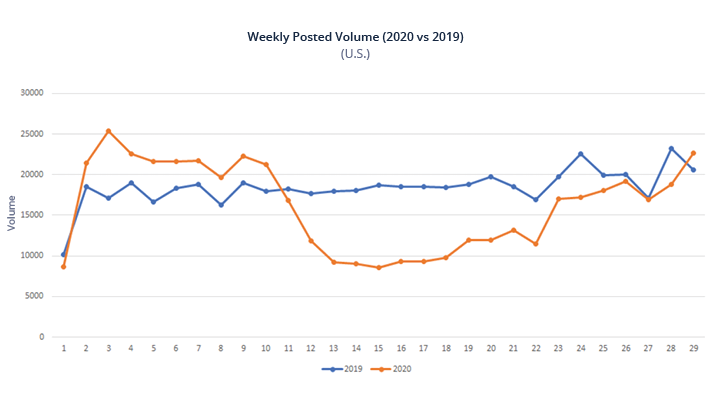

Volume trends up despite fluctuations

After a decrease in week 27 (the week of July 6), overall work volume on the Field Nation marketplaces is on the rise again in week 29 (the week of July 20). What caused the temporary decline? While it’s difficult to say for certain, new COVID-related restrictions likely contributed. More than half of U.S. states have now paused or reversed their reopenings, which can have a ripple effect on field services.

During week 29, work order volume increased by 10 percent. Overall, work order volume is normalizing around 2019 levels. We believe that weekly fluctuations will continue as field services businesses adapt to the “new normal.”

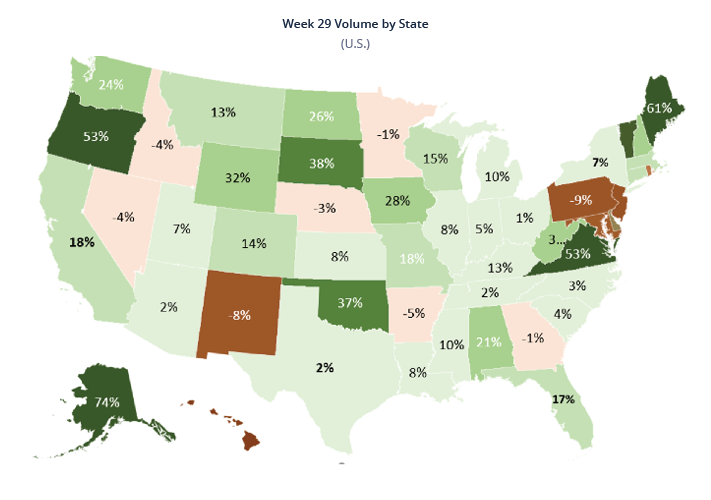

Geographic trends show positive signs

Nearly 40 out of 50 states have now reported positive year-over-year growth.

Similar to findings in our previous Field Nation report, the largest states continue to make dramatic gains. California, Texas, New York, and Florida have surpassed their 2019 volumes.

More companies contributing to a growth pattern

Another encouraging trend is the growing number of companies contributing to the recovery. In week 26, 45 customers comprised 80 percent of our marketplace volume. By week 27, 80 customers contributed to 80 percent of marketplace volume. Last week, week 29, 117 customers made up 80 percent of the volume.

The market recovery becomes increasingly sustainable as growth spreads across a larger base of companies.

Businesses experiencing “V-shaped” growth

Across our customer base, we see many additional companies experiencing a “V-shaped” recovery. While many businesses are still operating at lower volumes, the activity level is steadily improving. Here are a few of the recent projects we have seen across our marketplace:

- Point-of-sale installation for coffeehouse chain

- Outdoor digital signage troubleshooting for a restaurant chain

- Emergency break/fix work for a discount retailer

- Site survey and install for automated package lockers

- In-home installations for accessibility devices

- Point-of-sale, networking, and security work for automotive services

Despite virus-related closures and slowdowns, data from our network points to a continued steady market improvement despite ongoing volatility. Equally promising, an increasing number of companies, in a growing number of states, are showing signs of recovery.

RELATED RESOURCES

More from the field

- Field Service

- Industry Trends

- Field Service

- Product Updates

- Blog

- Best Practices

- Business Growth

- Blog