Contents

- 1. Mixed economic signals influence consumer spending

- 2. High capital costs restrain business spending

- 3. Field service work rebounds

- 4. Technological advancements drive service innovation

- 5. Data center projects surge with 23% growth

- 6. “Retailization” of healthcare transforms service needs

- 7. E-commerce growth spurs warehouse automation

- 8. AI powers higher retail revenue

- 9. Tech convergence drives 46%+ lift in AV and digital signage work

- 10. Physical security systems see rapid adoption, driving 13+% growth

As we navigate an evolving economic landscape, several key field service trends are shaping the business environment over the next 12 months.

At Field Nation, we constantly gather insights from our customers about the challenges and opportunities they face. Drawing from these insights, we’ve identified 10 pivotal trends to watch:

1. Mixed economic signals influence consumer spending

The macroeconomic environment remains volatile, with economists expressing mixed views on the potential for a recession. This uncertainty has led to restrained consumer behavior, particularly in discretionary spending.

While necessary items like staples continue to see steady sales, big-ticket items are experiencing a slowdown. This cautious spending is affecting retail sales, which showed year-over-year growth of 2.3% in May, slightly below the National Retail Federation forecast of 2.5% to 3.5%.

2. High capital costs restrain business spending

Federal interest rates, currently between 5.25% and 5.5%, are contributing to increased capital costs. This has led businesses to rationalize their capital expenditures, including new store openings and remodels.

Many businesses remain optimistic about potential Federal Reserve rate cuts later in the year, which could stimulate more projects. In the meantime, businesses are adapting to high capital costs by strategically allocating resources to high-demand areas.

As one service delivery executive recently shared, “Although our customers are taking a measured approach to project work, the work is happening and expected to continue in the second half.”

“Although our customers are taking a measured approach to project work, the work is happening and expected to continue in the second half.”

3. Field service work rebounds

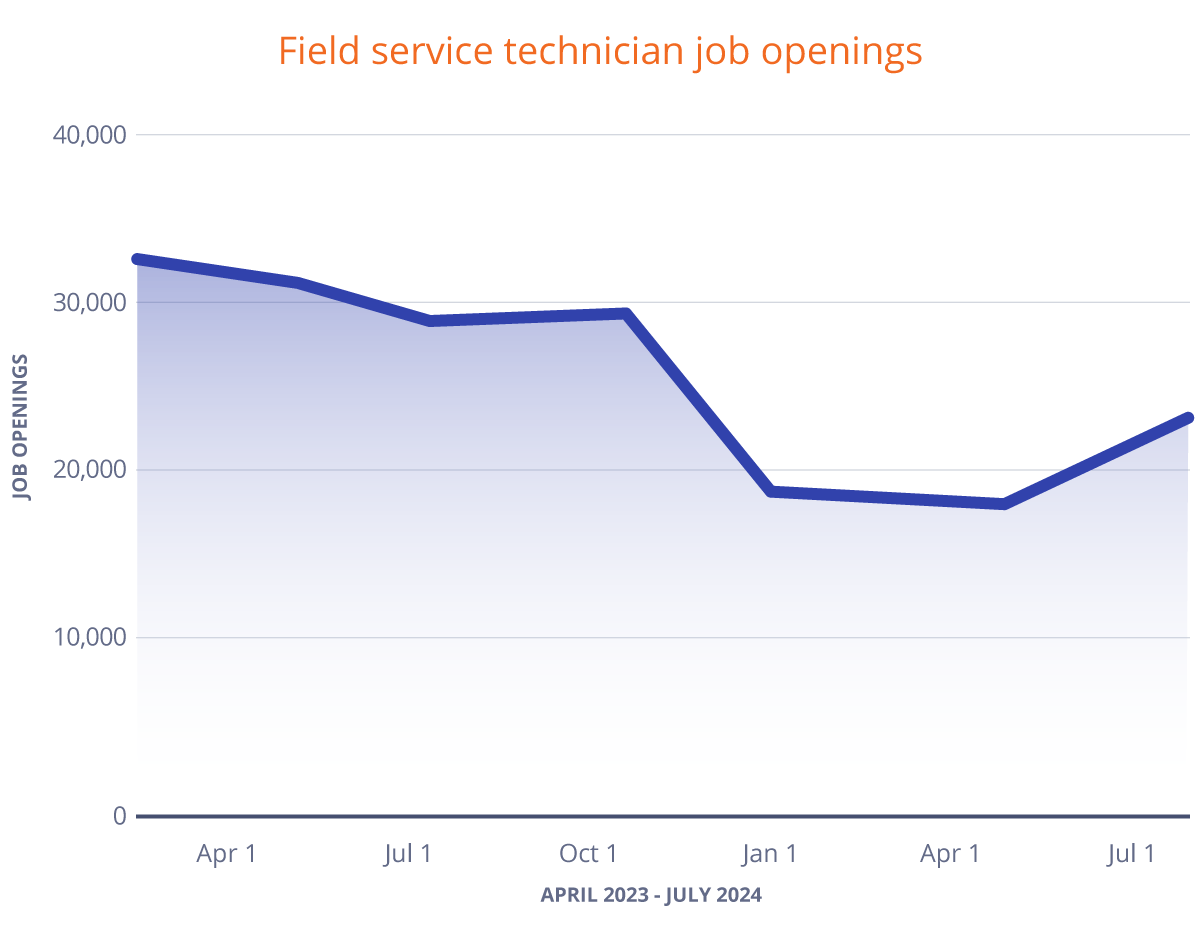

Indeed jobs data shows that overall openings for field service technicians have increased to over 22,000 after a period of decline, signaling an expected upturn in work for the second half of the year. While the overall labor market has eased, finding highly skilled professionals, especially level 2 and level 3 technicians, remains challenging.

Companies are responding to this anticipated increase in activity by ramping up hiring efforts, investing in training programs, exploring innovative staffing solutions through labor marketplaces, and leveraging remote support capabilities.

4. Technological advancements drive service innovation

Despite economic headwinds, the field service industry continues to benefit from the rapid evolution and proliferation of technologies.

Key growth areas include the Internet of Things (IoT), AV technology, digital collaboration tools, and hybrid workforce solutions. The digitalization of physical spaces, such as the adoption of electronic shelf labels (ESLs) and smart devices in retail, is driving demand for advanced digital solutions. Wi-Fi upgrades from 6 to 7 are also on the horizon, supporting the increasing number of smart devices across various sectors. These advancements are creating new installation and expansion opportunities for service providers.

5. Data center projects surge with 23% growth

The need for data centers continues to grow, driven by the massive increase in data volumes and the proliferation of smart devices. While the initial wave of new data center constructions has slowed, the focus has shifted to expanding storage capacities within existing facilities. Such developments are expected to sustain growth in data center investments at a compound annual growth rate of 10% through 2030.

Field Nation data supports this trend, showing a 23% year-over-year increase in work order volume for data center-related projects.

6. “Retailization” of healthcare transforms service needs

Another notable trend is the “retailization” of healthcare, where large retailers are incorporating healthcare clinics within their stores. This “shop-in-shop” model delivers added value to consumers by offering convenient and accessible healthcare services.

This shift will likely elevate demand for digital signage, kiosk installations, and other infrastructure. Reflecting this trend, Field Nation data shows a 46.2% year-over-year uptick in digital signage and AV work orders.

7. E-commerce growth spurs warehouse automation

The e-commerce boom is driving the need for advanced networking solutions and warehouse automation. Investments in Wi-Fi infrastructure, fiber optics, and other networking technologies are critical to support the efficient operation of modern warehouses.

This trend highlights the importance of robust connectivity solutions in the logistics and supply chain sectors. Field Nation platform data indicates a flat trend in networking-related projects year-over-year.

8. AI powers higher retail revenue

Artificial intelligence (AI) and smart devices are becoming integral to retail operations. Over the past year, 69% of retailers attributed increased annual revenue to AI, while 72% reported a decrease in operating costs.

Technologies such as AI-driven surveillance systems, smart shelves, and interactive kiosks are enhancing the customer experience and operational efficiency. These innovations are expected to continue shaping the retail landscape, providing new opportunities for service providers.

9. Tech convergence drives 46%+ lift in AV and digital signage work

The hybrid workforce model, which combines remote and in-office work, is here to stay. This shift has spurred significant investments in upgrading meeting room equipment, digital collaboration tools, and AV systems. The convergence of AV and IT technologies is creating new opportunities for service providers to offer comprehensive solutions that enhance digital collaboration and productivity.

This dynamic is reflected in Field Nation’s platform data, which reveals a 46% year-over-year uptick in digital signage and AV work orders.

One service delivery executive recently noted, “Before the pandemic, conference rooms were very boardroom-like. Today, they’re more huddle room-based, allowing faster, more standardized deployments.”

“Before the pandemic, conference rooms were very board-room like. Today, they’re more huddle room-based, allowing faster, more standardized deployments.

10. Physical security systems see rapid adoption, driving 13+% growth

An increased emphasis on safety and loss prevention is driving a surge in physical security system installations across various industries. Retail and education sectors, in particular, are ramping up investments in advanced surveillance and access control technologies to address rising concerns about theft and overall safety.

Field Nation has observed a 13.8% increase in security-related spending year-over-year, with a notable rise in demand for IP camera installations and door access control systems. This trend underscores the opportunity for field service companies to expand their offerings and expertise in this rapidly growing segment.

Embrace change and seize opportunities

These 10 trends paint a picture of a dynamic field service industry. For companies, adapting strategies to these emerging opportunities can drive growth and efficiency. For technicians, these trends highlight areas where developing skills can lead to increased work opportunities.

For more insights and solutions tailored to your field service needs, connect with the Field Nation team.