As we step into 2024, the economic landscape shows mixed signs. Some economists are cautiously optimistic about a “soft landing,” while others think a recession is merely deferred. A recent survey of leading economists indicates a decrease in the probability of recession from 48% to 39%.

At the same time, services inflation remains persistent and currently stands at 5.3%. Consumer spending has shown signs of softening, though the extent is less than anticipated. Spending during the holiday period increased nearly 4% in 2023, a slower pace than in the previous three years but in line with pre-pandemic trends.

Retail is a major driver of field service spend. A pullback in discretionary spending and the increased cost of capital have contributed to postponed investments in certain field service projects, while other categories are accelerating due to a continued emphasis on automation and customer experience.

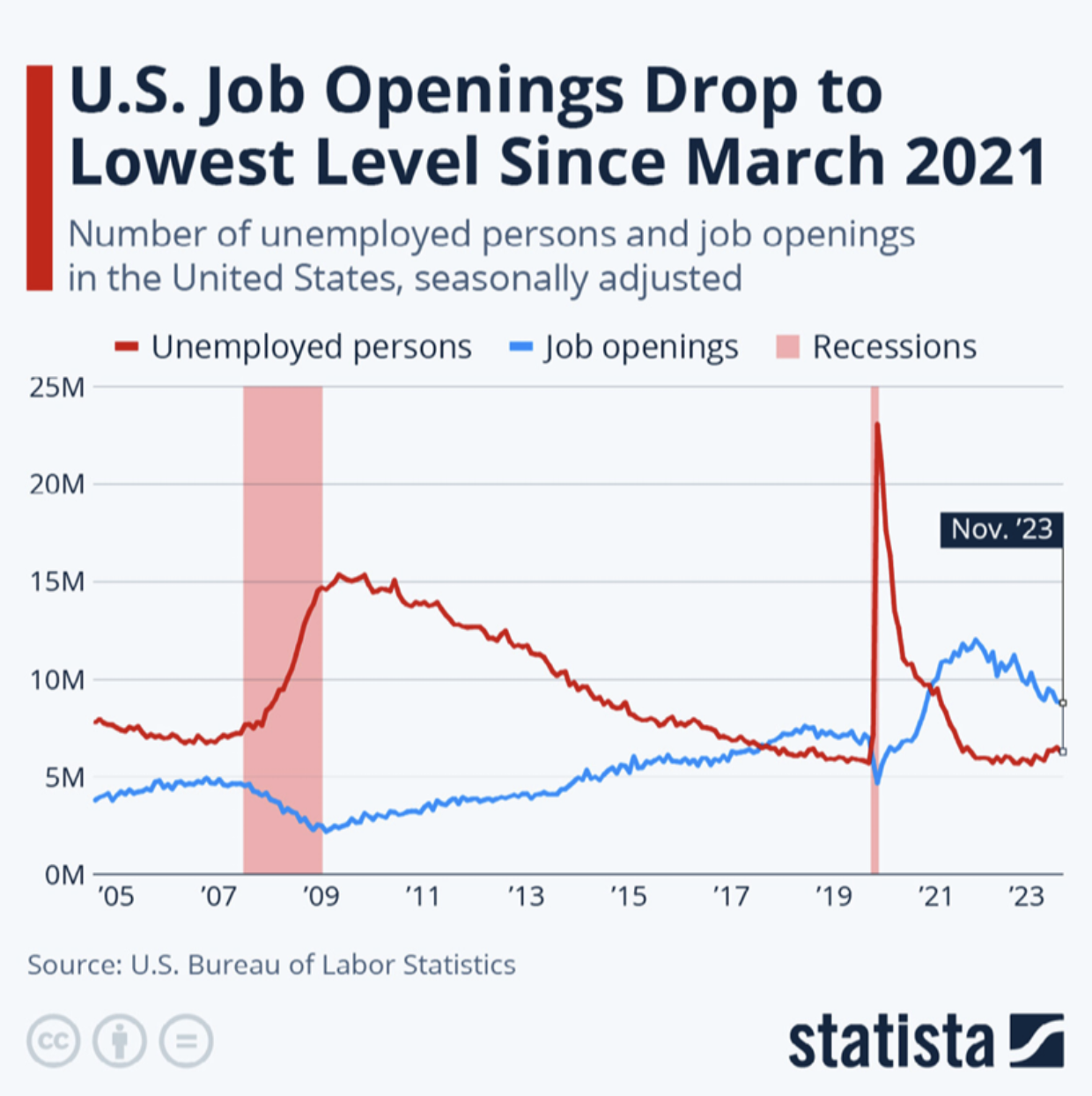

Turning to the workforce, the field service sector is grappling with a structural deficit—the skilled labor shortage. Job openings are at their lowest since March 2021, influenced by high capital costs and subdued demand. The labor participation rate is stagnant at 62.5%, with a lack of participation from younger workers and attrition among experienced technicians. In the tech realm, the unemployment rate remains remarkably low at 2.3%.

However, a notable trend has emerged: a significant rise in independent workers. Across many industries, including field service, workers opt for independent contractor roles to have more control over their work and their time. While some workers become full-time contractors, others do independent work to supplement full-time employment.

According to the MBO Partners State of Independence report, 72.1 million Americans are independent workers, about 45% of the workforce. In a recent study of field service technicians, 98% of respondents prefer independent contracting in some capacity. Experienced workers have not disappeared; they have chosen to work differently.

For more insights into macroeconomic and labor trends affecting the field service industry, access our complete white paper on 2024 trends and predictions based on proprietary data from the Field Nation marketplace.