By Wael Mohammed, EVP of Strategy, Field Nation

There are few things more unsettling than volatility, especially when making plans for your company’s future.

Present market conditions make it difficult (if not impossible) for field service leaders to anticipate demand and resource against rising material and labor costs. Supply chain issues and chip shortages complicate new opportunities, putting large-scale projects on hold with little indication of what a revised timeline will look like. To cap it all off, fears of a potential recession cast a dark cloud over the business world.

It is tempting to look at these thorny market conditions and conclude that the economy and the field service industry are heading for a dark period. But this line of thinking doesn’t give service leaders the full picture of where the industry is headed or how they should prepare.

To guide field service leaders through the current challenges, we’ve dug into data from the millions of field service jobs completed on our platform. We’ve cultivated insights to help you understand the drivers of market volatility and learnings from previous periods of economic uncertainty. And we’ve developed three concrete strategies to help you survive (and thrive) in the here and now.

In short:

- 2023 is shaping up to be a year defined by volatility.

- Present volatility is being driven by supply chain issues, the tension between inflation and high demand for field services, and uncertain consumer behavior in the retail sector.

- Winning service companies need to arm themselves with a deep understanding of these drivers of volatility to forge the smartest path forward.

- Specifically, they should consider changing from a fixed expense structure to a variable expense structure, increasing service capabilities to expand scope with existing customers, and aligning service offerings with evolving consumer behavior.

Interpreting mixed messages in the field service space

As the current market makes excruciatingly clear, every period of economic volatility presents unique complications and contradictions.

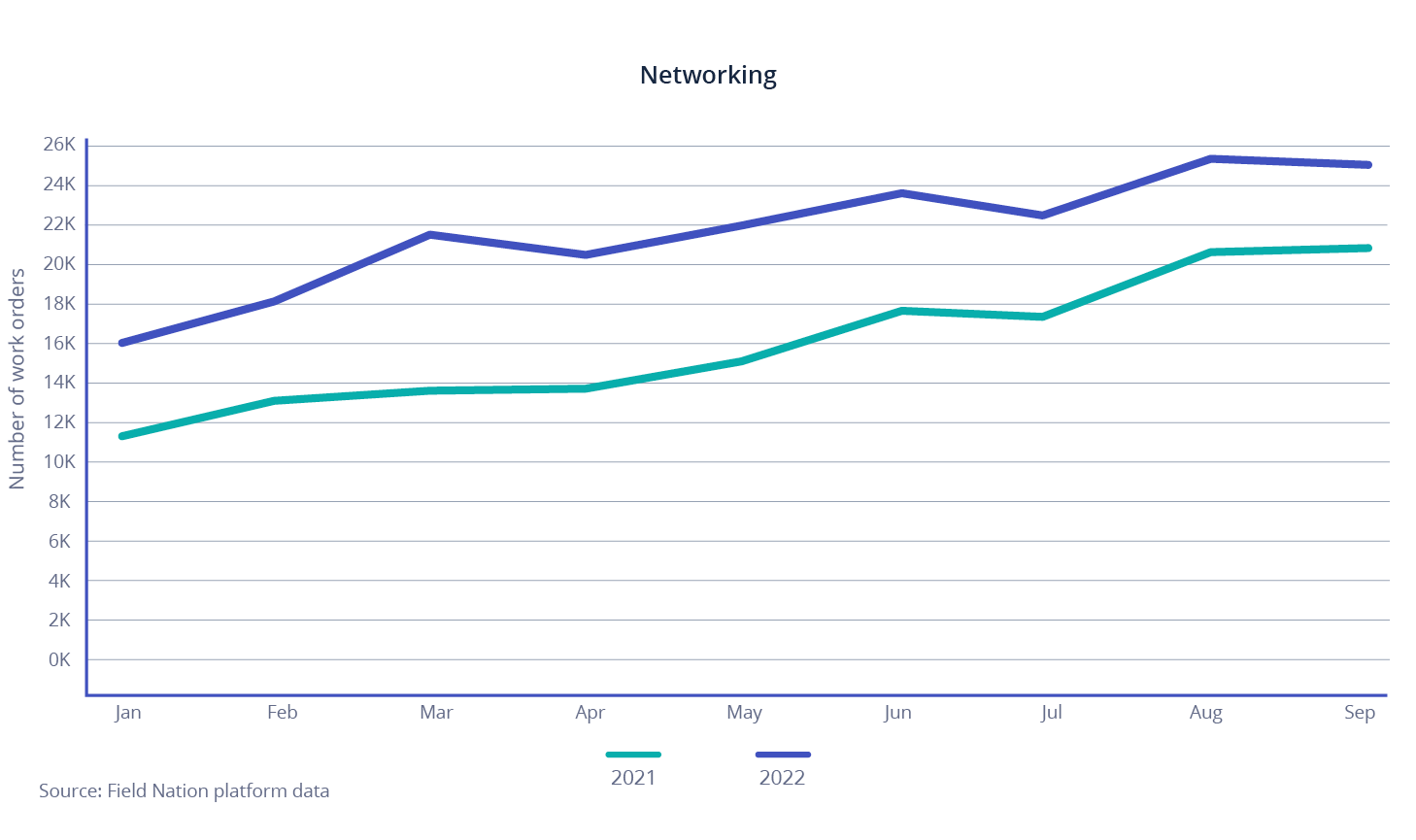

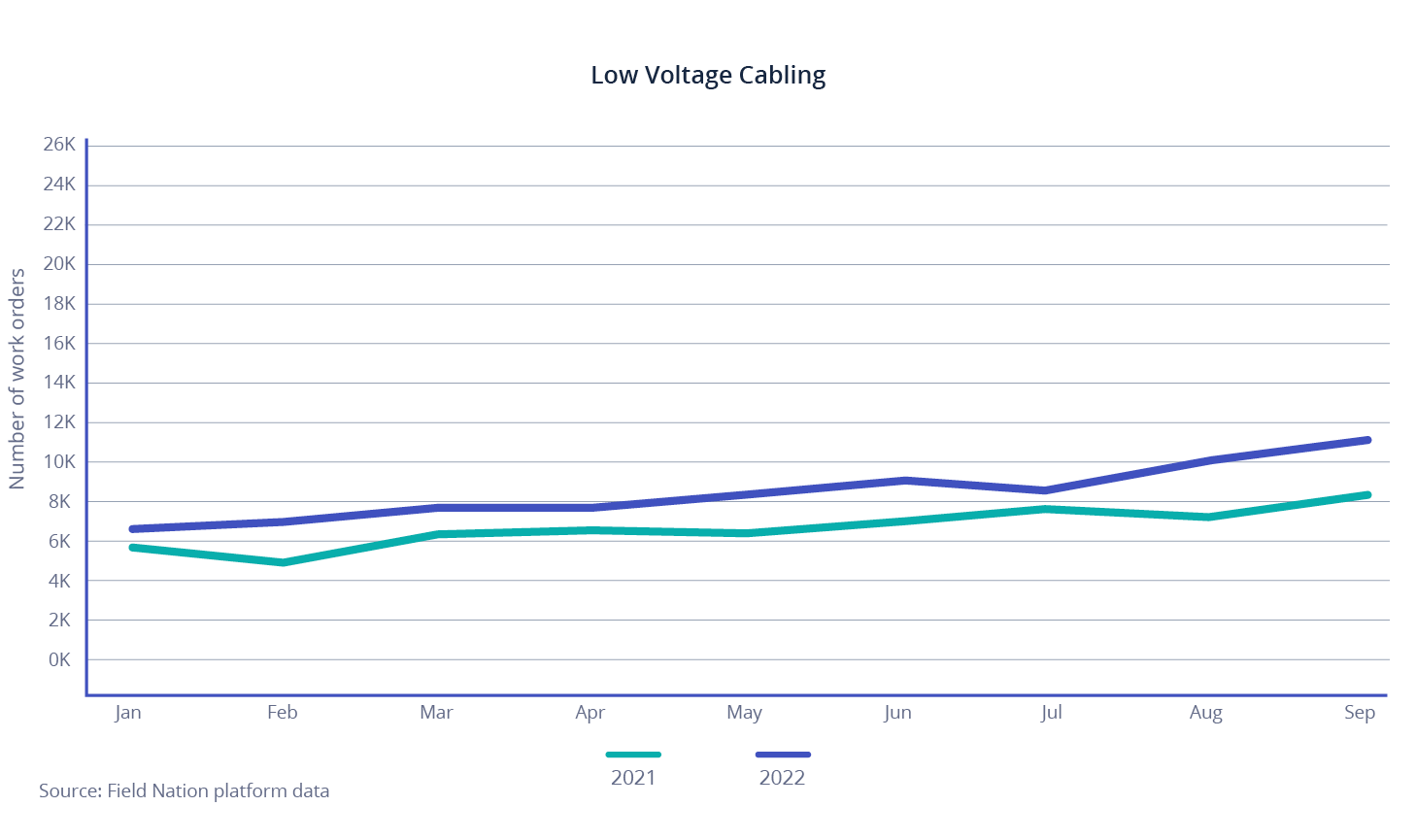

Overall, the volume of work completed through the Field Nation platform is up 16% YoY. Cabling and networking are experiencing pronounced YoY growth, with a 26% increase in work volume each. This suggests that infrastructure projects should remain a heavy draw for field service organizations going into 2023.

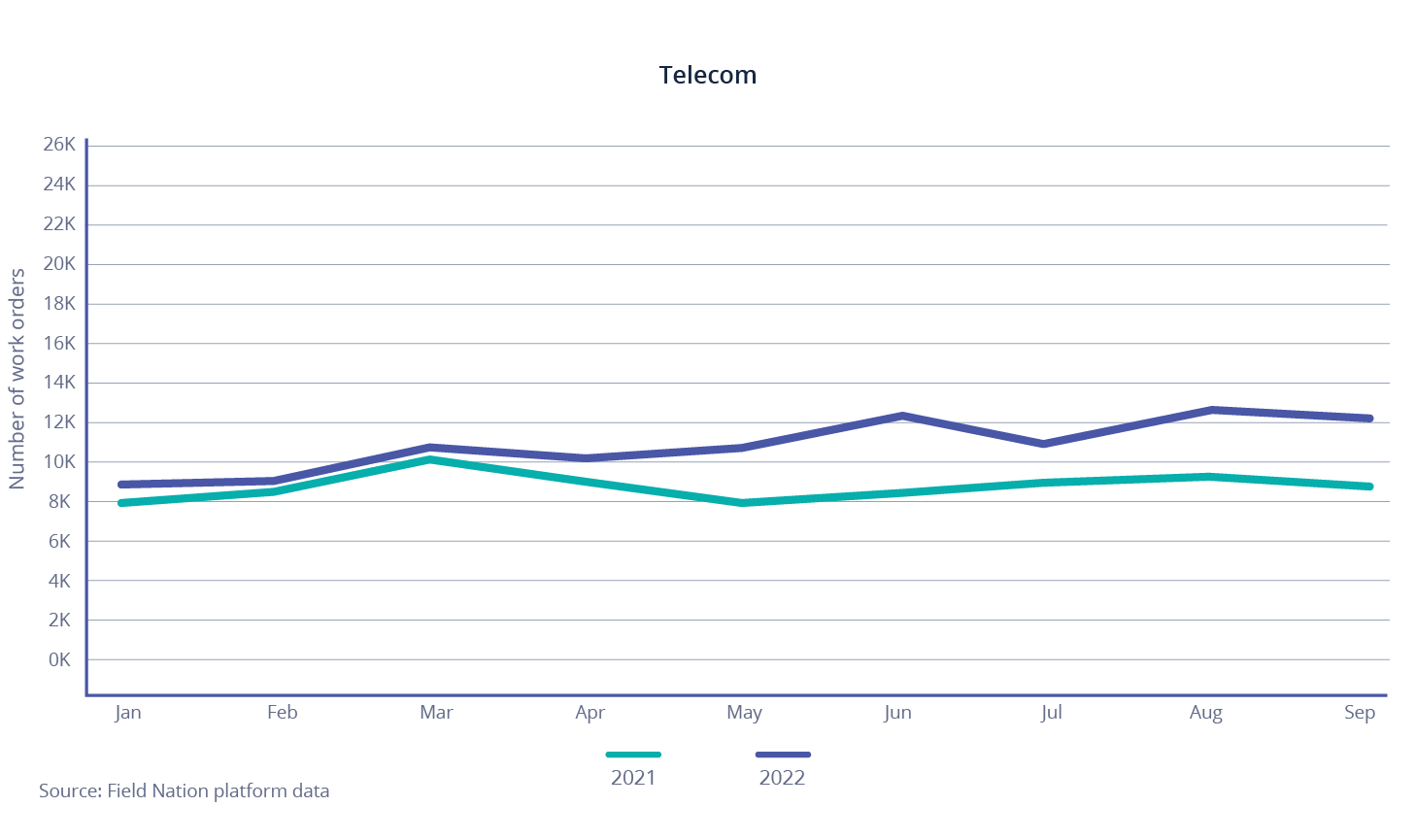

The volume of telecom jobs is also up––30% YoY as of Q3––which aligns with the continuing push from companies in all industries to bring work back into the office. 2022 was the year that this trend really picked up steam.

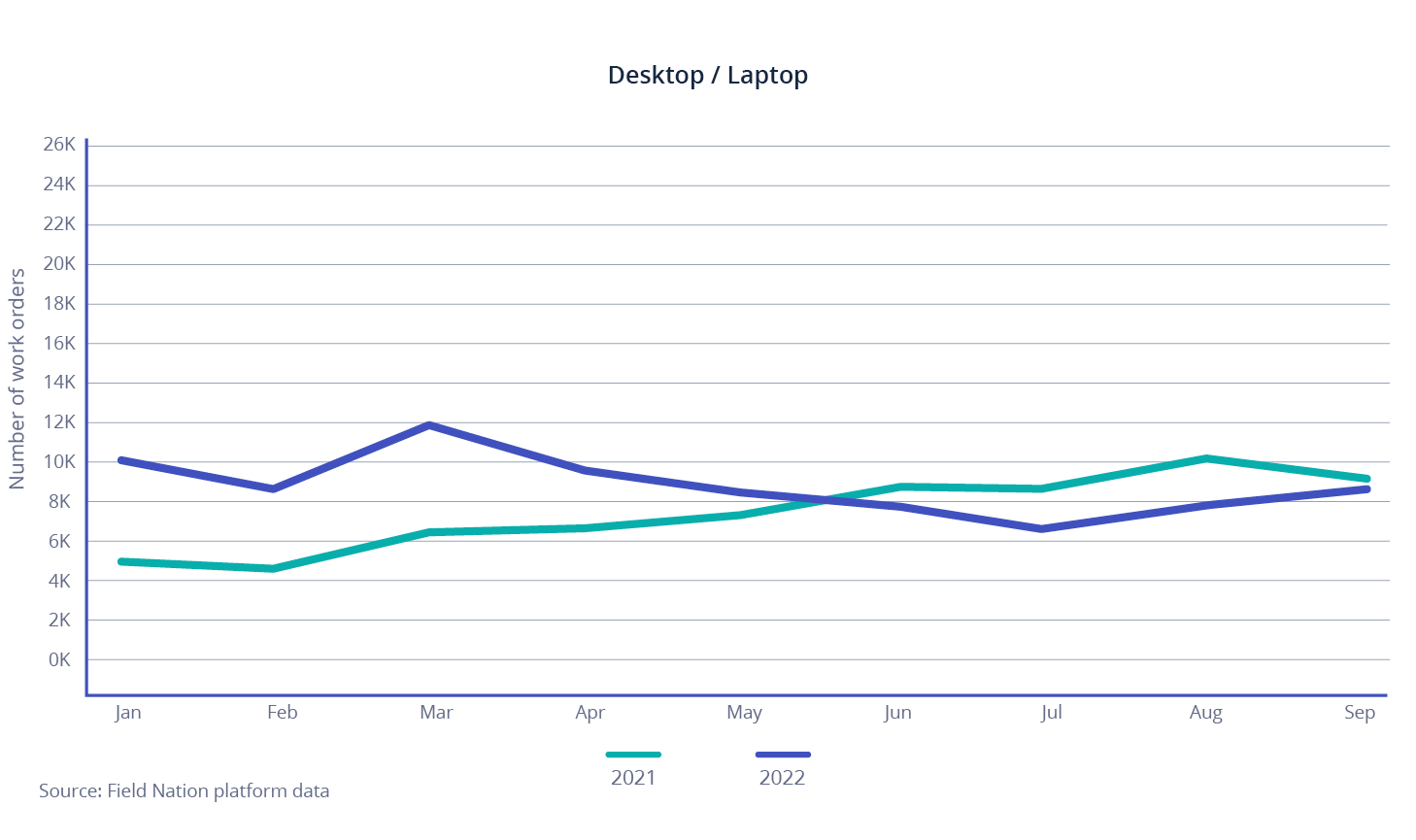

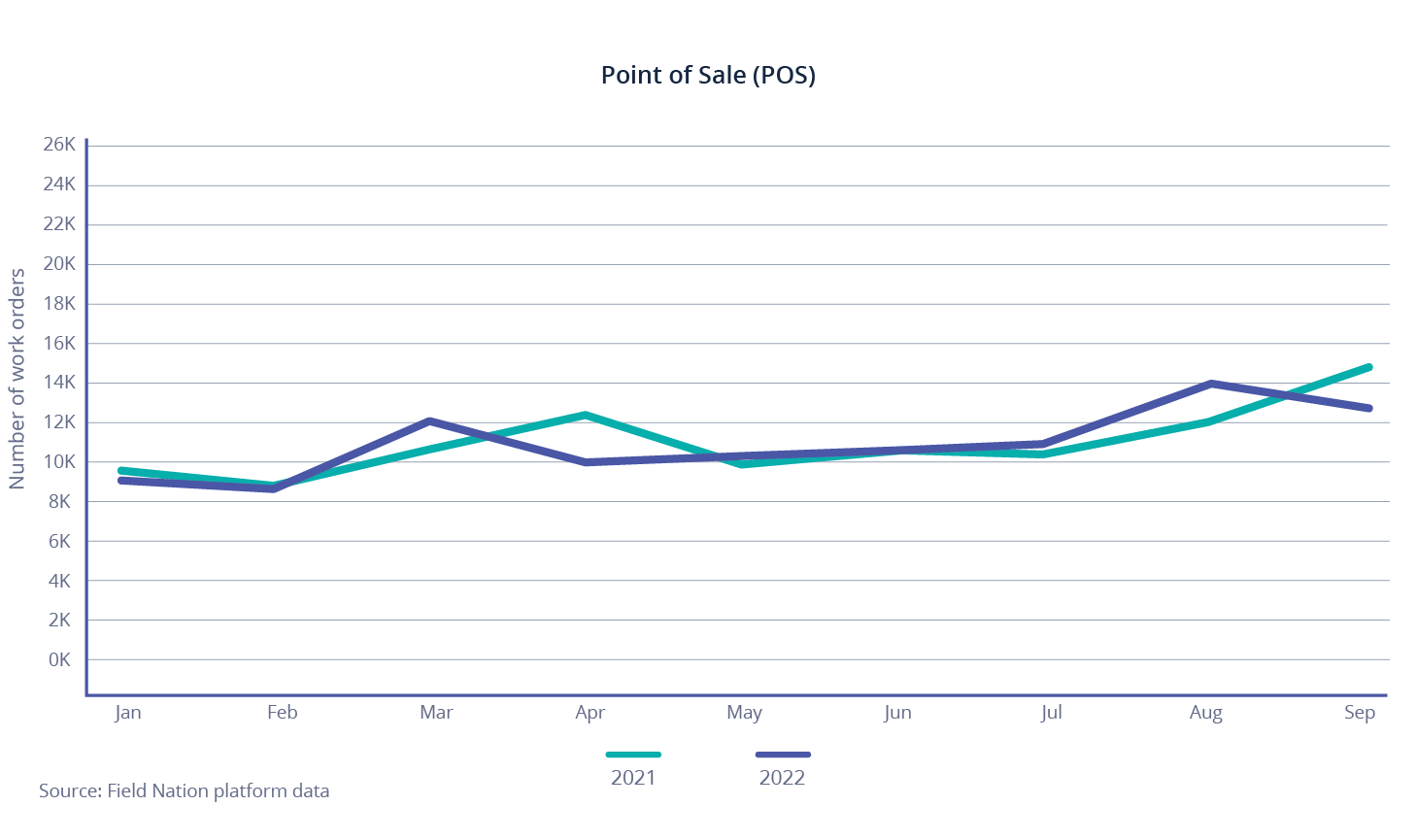

Desktop/laptop work, which dipped below 2021 levels earlier this year, has rebounded in Q3. Other work types are experiencing more muted growth, or no growth at all––point-of-sale being the most salient example of this trend.

This slowdown in point-of-sale installations is directly related to uncertainty in the retail space.

The bottom line is this: The field services industry faces both tailwinds from continuing high demand for field service deployment and headwinds from external market conditions. The conflict between these two forces is responsible for the current market volatility.

A closer look at drivers of volatility

On any given day, you might read that a recession is on its way, or that recession fears are vastly overblown, or that we’re already in the middle of a recession. On one hand, retail has bounced back to full force, making it the first industry to fully rebound from its post-pandemic slump. On the other hand, the Federal Reserve is taking aggressive steps to cool the economy down in an effort to stymie inflation. Economic signals have been mixed, to put it mildly.

What everyone can agree on, however, is that we are living in volatile economic times. Field service leaders need to arm themselves with a deep understanding of this volatility to forge the smartest path forward. Here are the three drivers of volatility they must watch most closely:

1. In retail, uncertainty reigns

There is perhaps no better example of the tumultuous and confusing road back to normalcy than the retail sector. As consumers shifted their spending to travel and leisure around March 2022, big players like Walmart and Target were left sitting on a mountain of goods they couldn’t move. But in earnings calls last month, both retailers announced they were almost back to where they want to be, signaling that 1) retail is resuming its place as a driver of the economy and 2) the current economic impact of this development remains largely unclear.

Interpreting these mixed signals has led many retailers to become more cautious with their capital spend as they wait to see which direction the consumer heads next.

For field service organizations, this translates into an uncertain mandate. There has been and will continue to be significant tech investment at sites nationwide driving automation and the omnichannel experience, e.g. sensors, digital signage, and self-service equipment. But project backlogs for 2023 are the direct result of the prevailing “wait-and-see approach” that keeps retailers from committing capital expenditure due to broad economic concerns. Field Nation is hearing feedback from clients, including multi-billion dollar OEMs, that their pipeline is significantly short of projections.

2. High demand is at odds with inflation

Inflation continues to plague the US economy: Non-farm business sector labor costs have risen 9.3% percent over the past four quarters. Some companies are delaying bids on new projects as a result.

However, as illustrated in the opening section of this article, there are strong indications that demand for field services remains high.

In the retail sector, mission criticality is moving from the back of the store to the front of the store as retailers shift their focus from servers to cameras and sensors. Retailers are transforming how they collect and leverage data on inventory and consumer behavior, which means the technology integral to that trend (as well as the field services necessary to install and maintain it) will be essential to the immediate future of the industry.

So while inflation and other market pressures continue to put the deployment aspect of field services in a bind, it’s important to acknowledge that the work itself is tethered to key retail priorities, which translates into distinct opportunities for field service. The reaction between these conflicting market influences injects volatility into what would otherwise be an uncomplicated period of high demand in the industry.

3. Supply chain issues make the future unclear

Everyone in the United States has felt the effects of supply chain disruptions over the past year. Service leaders have experienced this crunch directly and painfully as material deficiencies––especially chip shortages––undermine their efforts to take advantage of new opportunities. We have heard from clients, including a multi-billion dollar VAR, that supply chain issues have been a primary driver behind the inability to deliver project deployment services in the second half of 2022.

While there are signs that some supply chain issues are improving, they remain a principal driver of service organizations delaying work they would otherwise be prepared to execute now. Eventually, problems with supply chains should resolve more fully. But until then, service organizations unfortunately find themselves playing the waiting game.

Learning from the past

The future, in other words, is uncertain. It’s a frustrating truth, but it’s a truth nonetheless. The field services industry could continue (or accelerate) its networking and cabling deployment-driven growth, or, in the event of a full-fledged recession, it could take the same hit as the economy at large.

For now, it’s natural to ask: What if the economy takes a dive? What should field service leaders expect in that type of scenario? What type of recovery timeline should they expect?

When it comes to large-scale economic disruption, the field service industry presents a few key, consistent patterns. Field Nation data presents a rich portrait of these patterns, which field service leaders can and should take into account as they finalize their 2023 planning.

In 2020 we saw an immediate drop in both project and break/fix work. Break/fix experienced the most dramatic initial drop (65%), but it also experienced the quickest rebound. Within four weeks of the initial downturn, break-fix work had returned to 90% of its 2019 volume. The remaining 10% drop can be explained by service companies finding new ways to respond to these jobs (e.g. remote support, self-diagnostic equipment, etc.).

The drop that project work experienced was more modest (40%). Within two quarters, this type of work was back to 100% of 2019 volume. This longer recovery period is related to site unavailability (i.e. technicians not being able to work in person during the height of coronavirus restrictions). The upside in this scenario was that the budgets funding these projects had already been allocated before the pandemic arrived. Accordingly, when the sites reopened and it was deemed safe to work, project work could resume at 100% capacity with support from pre-allocated funds.

As the above example illustrates, 2020 presented its own distinct challenges, some of which don’t transfer to other types of economic disruption. The current phase of economic unease doesn’t have the cushion of pre-allocated budgets that must be spent. Rather, uncertainty over the economy’s immediate future results in lower project budgets.

Still, previous moments of economic volatility provide a blueprint for how the field service industry responds in moments of crisis––and how it bounces back. In the absence of a crystal ball telling us which direction the economy is headed, this is useful intel for field service leaders as they plan for 2023.

My message to you is this: Don’t ask yourself what is going to happen, ask yourself how adaptive you are. The smartest thing to do in the midst of uncertainty is to integrate agile and flexible processes into your organization so that you are prepared to win through volatility.

How to win in an uncertain market

Field service leaders are not strangers to adjusting their business strategies based on seasonality or fluctuating demand for certain types of services. But even considering the baseline unpredictability of the industry, this present moment is uniquely difficult.

The truth is that 2023 is shaping up to be a year defined by volatility. Any analysis that dodges this essential truth or simplifies it into unsupported certainties does field service leaders a disservice by distracting them from what should be their primary concern: building up their businesses into operations that can survive (and thrive) through volatility.

So, is winning possible in 2023? The answer is yes! Here are three things top service leaders can do to thrive amidst the current volatility.

1. Shift from a fixed expense structure to a variable expense structure

Fixed expense structures chain your organization to a business-as-usual approach during very unusual market conditions and put you at a disadvantage relative to your competitors who are making the switch to variable expense models. Service organizations that shift to a variable expense structure by embracing a blended workforce will be well-positioned to ramp with speed when tangled supply chains and other drivers of market volatility begin to level off.

2. Increase service capabilities to expand scope with existing customers

In a volatile market, winning service organizations will focus on providing as much value to existing customers as possible. Depending on your organization’s capacity, this may mean expanding into additional support skillsets or geographies. Tapping into alternative talent sources like on-demand labor platforms makes this task easier.

3. Follow the consumer

Retailers remain cautious and observant when it comes to consumer behavior. Soon, when consumer expectations become clearer, retailers will spring into action with IT spending related to connected devices, BOPIS, automation, projects needing to be completed that have been delayed, etc. Service organizations that keep their fingers on the pulse of these developments in consumer behavior will be ready for that flurry of work.

If you are interested in learning more about how Field Nation can help you meet demand, connect with our team for more information about on-demand labor and navigating the changing field service landscape.