Recovery continues as second half of 2020 kicks off

July 9, 2020

Insights posted 7.9.20

As we start the second half of 2020, our latest Field Intelligence report points to a continued recovery across the industry.

Data from our network suggests an optimistic outlook for field services. Volume continues to improve, while various work types and industry sectors sharply rebound. However, as many states begin to pause or roll back reopenings, the coming weeks will highlight just how variable growth can be across states and types of work.

Volume approaches 2019 levels

Previous Field Intelligence reports have shown the field service industry steadily recovering. For the first time since February 2020, work order volume approached 2019 levels. For week 27 (the week of July 6), overall volume was just three percent lower than the same week in 2019.

Growth remained strong across a wide spectrum of businesses. In the past 12 weeks, work order volume has increased by 106 percent, reflecting a dramatic turn from the low point of the market. Generally, we see an “L-shaped” recovery taking place across the industry. However, several high performing companies are experiencing “V-shaped” improvements.

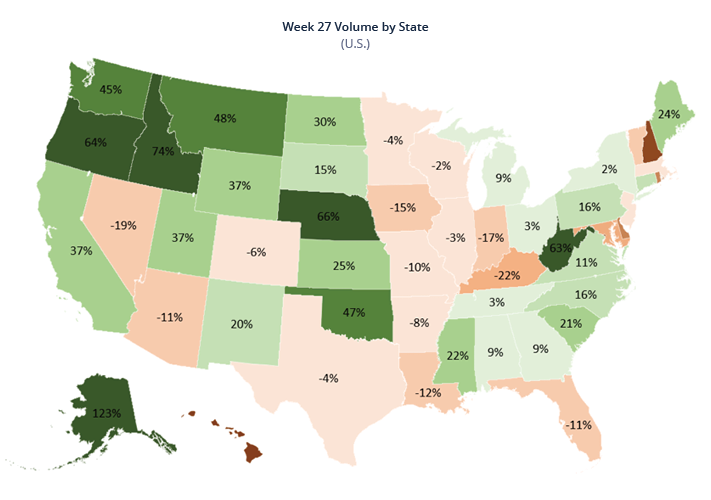

Many states show ongoing recovery

The largest states in the U.S. in terms of gross domestic product (California, Texas, New York, and Florida) continued to show improved volumes. Over the past several weeks, we have seen consistent growth in Texas and New York. In addition, California has experienced semi-consistent improvement and Florida showed fluctuating growth.

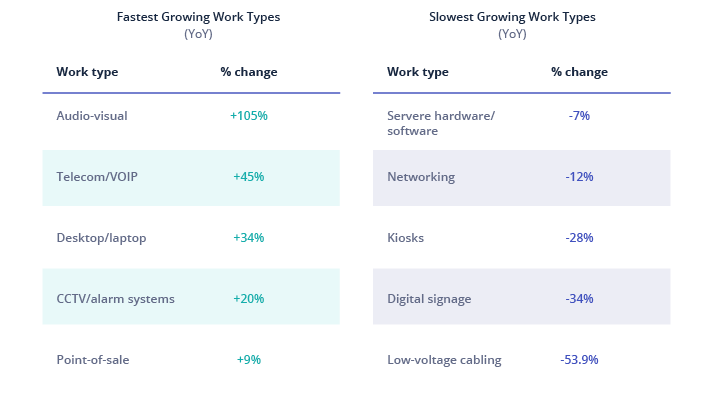

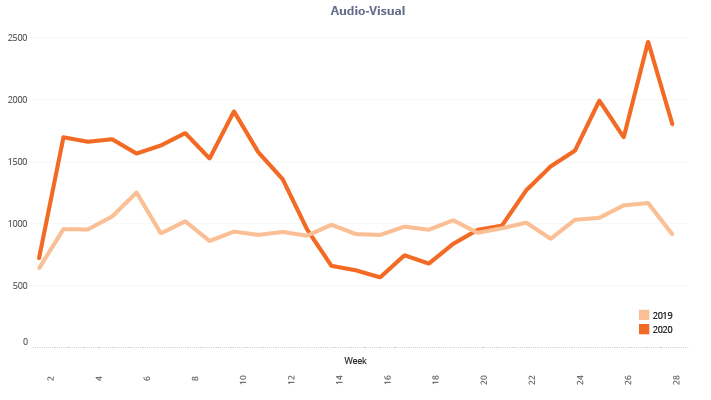

What types of work are rebounding the fastest?

We are seeing surges across certain work types, such as audio-visual and telecom projects. In contrast, other sectors—including kiosks and digital signage—show a more measured recovery.

Here are year-over-year trends across the Field Nation marketplace of 7,000+ clients for key work types.

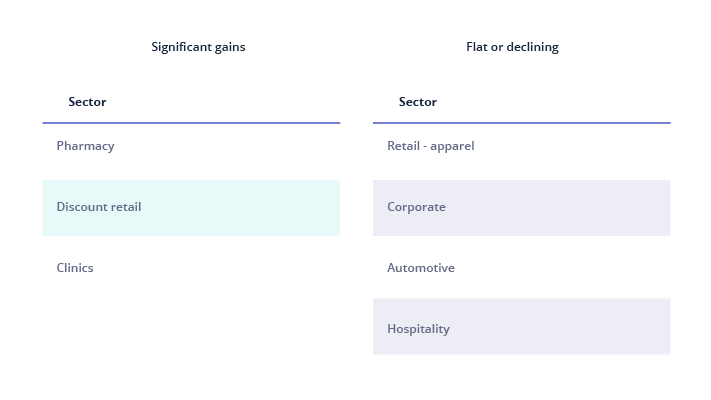

How are different business sectors performing?

We are also seeing conflicting trends among business sectors. Some types of businesses have experienced dramatically increased work volume. In contrast, others have struggled or remained flat.

These trends closely mirror broader shifts in consumer spending to essential services.

Growing connections between businesses and technicians

The number of companies posting work and seeking workers on the Field Nation platform has now matched 2019 levels. This represents a 24 percent increase over the week 15 market low.

Similarly, the number of workers using the Field Nation platform continues to rebound. Last week, 4,515 technicians used the marketplace, a 27 percent rise over the bottom of the market.

Weekly active connections have increased 62 percent in the past 12 weeks. Also, 13 percent of these connections are new. Growth in new connections shows how businesses and technicians continue to find value using the Field Nation platform. Their shared success is a promising indicator of recovery.

Field Intelligence experts

Wael Mohammed has been in the IT services industry for more than 27 years. He has held leadership roles in both startups and large enterprises, including SPS Commerce, IBM, and Target. Wael is currently the Executive Vice President of Product at Field Nation, and oversees product management, product design, and data science. He is a master in identifying product and market growth opportunities, taking new products to market, and maximizing product performance.

Steve Salmon brings more than 30 years of leadership experience to the IT services industry. He has held senior roles in both startups and large enterprises, even co-founding a technology services company in 1992, which was later purchased. Currently, Steve is the VP of Enterprise and Channel Sales at Field Nation. Previously, he served as SVP of Global Managed Services Solutions at CompuCom, where the services revenue grew from $200M to more than $1B. Steve’s expertise and strategic prowess have landed him on numerous radio shows as a technology and business specialist.

RELATED RESOURCES

More from the field

- Field Service

- Industry Trends

- Field Service

- Product Updates

- Blog

- Best Practices

- Business Growth

- Blog