Field Intelligence: Steady, broad-based recovery continues

June 25, 2020

Insights posted 5.25.20

Data from the Field Nation marketplace continues to signal a consistent improvement in market conditions. In this week’s Field Intelligence post, we’ll share insights into overall field services health, geographic trends, hourly rates, and fill rates—which all show signs of stabilization.

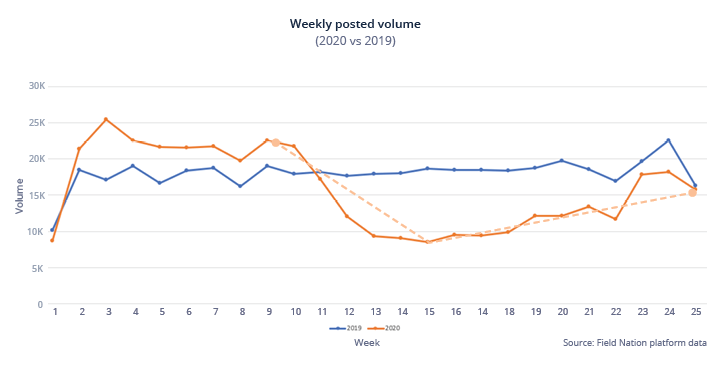

Volume jumps 70+ percent since market low

As we described in an earlier Field Intelligence report, we saw the lowest level of activity on our network during week 15 (the week of April 4), which we believe was the bottom of the market. For the following 10 weeks, work order volume has steadily increased.

Work order volume for the last three weeks has grown more than 70 percent from the market low. In the past week (the week of June 19), volume is only four percent below 2019 levels. This indicates a nearly “normal” activity level for the first time in several months.

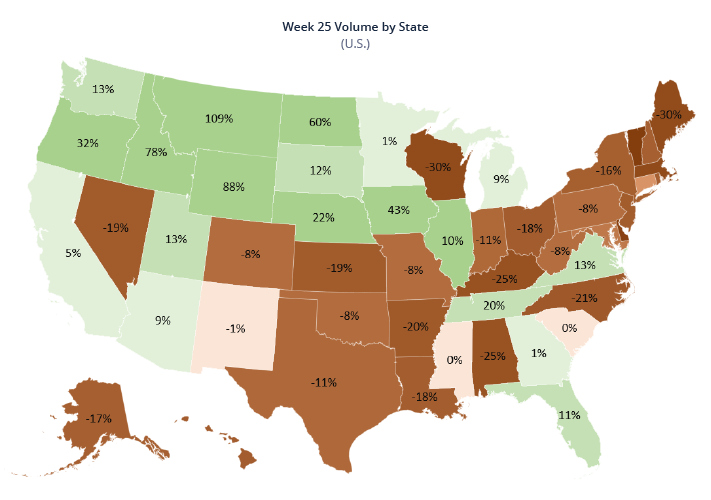

Large states continue to rebound

California, Texas, New York, and Florida—which are the largest states in terms of gross domestic product—continue the upward trajectory in work order volume that we reported in our last Field Intelligence report.

States like New York and Illinois have significantly rebounded in recent weeks. In addition, we see positive year-over-year growth in many states throughout the Midwest and Pacific Coast.

Work order value and hourly rates hold steady

The average value of work orders on the Field Nation network is approximately the same in 2020 as it was in 2019. This is a slight decline of 4.6 percent year-over-year.

Likewise, median hourly rates are consistent versus 2019 levels. Hourly rates have increased slightly in work types such as point-of-sale and networking with rates rising approximately 11 percent.

Fill rates remain robust

Current fill rates (which we define as the percent of published work orders that are assigned to a technician) are nearly identical to 2019 rates. Fill rates have remained healthy across the board, even for work orders with payment terms of 7 days or more.

To give our community flexibility during the pandemic, we recently eliminated cancellation fees, which has not had an impact on the cancellation rate for either businesses or technicians.

Combined, these metrics including strong work order growth, geographic stabilization, consistent hourly rates, and high fill rates bode well for the market recovery. Even in these turbulent times, the Field Nation marketplace is successfully connecting companies with the workers they need, and technicians with the jobs they want.

RELATED RESOURCES

More from the field

- Business Growth

- Field Service

- Blog

- Best Practices

- Field Service

- Blog

- Product Updates

- Blog