Summary

The retail industry is undergoing rapid transformation, driven by shifting consumer behaviors, evolving store formats, and technological advancements. While macroeconomic uncertainty may lead some to tread cautiously, field service leaders who look beneath the surface can find substantial growth opportunities. From store openings and closures to digital transformations and automation, the coming year presents a dynamic landscape where proactive service providers can thrive.

Our latest webinar highlights six key retail trends that are shaping the demand for field services. By understanding these shifts and preparing accordingly, field service organizations can position themselves as strategic partners to retailers navigating these changes.

1. Fast-paced store openings and closures

According to Coresight Research, 15,000 store closures are projected for 2025, the highest since the pandemic. These closures create immediate opportunities for decommissioning services, including equipment removal, data wiping, and asset recovery. Simultaneously, retailers plan 5,800 new store openings, with Dollar General and Dollar Tree accounting for 1,300 locations. Both scenarios drive demand for technology deployment, from structured cabling and networking to point-of-sale systems and security infrastructure.

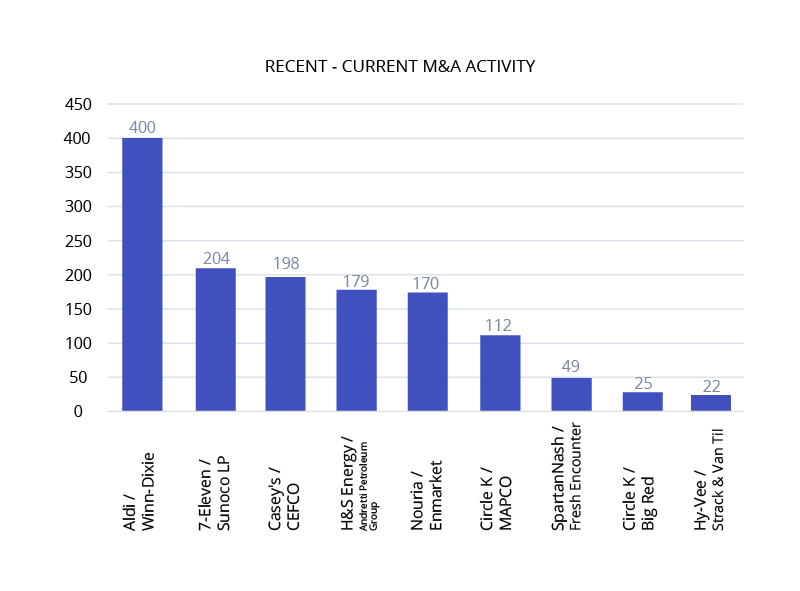

2. Mergers and acquisitions

Retail M&A activity is accelerating, particularly in the grocery and convenience sectors, where geographic expansion is essential. In 2025, Aldi plans to acquire 400 stores from Winn-Dixie, while 7-Eleven continues its expansion. These consolidations require significant technology integration work, including rebranding, point-of-sale standardization, and security system upgrades.

3. Digitalized in-store services and experiences

Retailers continue to invest in technologies that enhance the shopping experience, including self-service kiosks, mobile point-of-sale systems, and interactive displays. These digital transformations require robust wireless infrastructure and ongoing support. As stores become more connected, retailers are upgrading to Wi-Fi 6E and Wi-Fi 7 to support the increased bandwidth demands of these new systems.

4. Efficient store formats

The retail landscape is seeing its smallest average store size in 17 years at 3,200 square feet. Major retailers like Macy’s, Kohl’s, and Ikea are experimenting with these smaller, technology-intensive formats that maximize revenue per square foot while providing seamless customer experiences. These formats require advanced wireless networks for mobile POS and self-checkout, enabling a faster, more focused shopping experience.

5. Back office and autonomous retail operations

Traditional large-format stores continue to evolve into hybrid retail/fulfillment centers, requiring sophisticated automation systems. The shift supports growing e-commerce demands and enables more efficient inventory management, with microfulfillment capabilities serving both in-store and online customers. This transformation demands advanced robotics, RFID systems for inventory management, and enhanced networking infrastructure.

6. Frictionless asset protection

According to the National Retail Federation, retail losses from theft are projected to reach $140 billion in 2025. Retailers are implementing sophisticated protection systems that do more than prevent theft. Modern solutions combine AI-powered surveillance with valuable consumer analytics, requiring regular technology upgrades and maintenance.

What field service leaders can do next

The evolving retail landscape presents significant opportunities for field service organizations. To stay ahead, leaders should consider the following strategic actions:

- Expand Decommissioning and Deployment Services: With a high volume of store openings and closures, field service teams should refine processes for swift technology removal and installation, ensuring minimal disruption to retail operations.

- Strengthen M&A Support Capabilities: Retail acquisitions require extensive IT and security system integrations. Positioning your team as experts in rebranding and technology standardization can create long-term partnerships with growing retailers.

- Invest in Digital Infrastructure Expertise: As retailers adopt advanced in-store technologies, field service providers should enhance their skills in Wi-Fi 6E, Wi-Fi 7, and connected retail solutions to meet increasing connectivity demands.

- Optimize Support for Smaller Store Formats: Efficient, technology-heavy retail spaces need tailored field service solutions, including mobile POS support, self-checkout maintenance, and advanced networking capabilities.

- Advance Automation and Robotics Services: Retailers are increasingly leveraging automation for inventory management and fulfillment. Training teams to install, maintain, and repair robotic and RFID systems will ensure relevance in this evolving space.

- Enhance Security System Offerings: AI-driven surveillance and analytics will be a priority for retailers combating shrinkage. Providing installation and ongoing maintenance of smart security solutions can drive consistent service revenue.

Field service leaders who proactively align with these retail trends can position their organizations for sustained growth. By identifying key opportunities and investing in specialized capabilities, service providers can become indispensable partners in the retail sector’s ongoing evolution.

For an in-depth analysis of these and other field service trends, explore our Definitive Guide to Field Service Trends or watch our complete webinar.