Economic pressures are reshaping how and where field service work happens. Capital costs remain high, but investment continues in infrastructure that delivers a clear return. Service leaders who capture profitable growth understand these dynamics, move quickly when opportunities arise, and build operations designed for a volatile market.

Explore the key trends shaping field service—and how to stay ahead.

1. Profitability reshapes investment

Organizations are making disciplined investment decisions in 2026, prioritizing projects that deliver clear, near-term returns. While high capital costs and policy uncertainty continue to influence spending, companies capturing growth understand where demand is concentrated and adapt their strategies accordingly.

Market conditions are mixed

- The U.S. economy shows 1.8% GDP growth for 2026, down slightly from 1.9% growth in 2025

- Core CPI inflation held at ~2.7% in late 2025, with tariff impacts remaining relatively muted

- The Federal Reserve has cut rates to a range of 3.50–3.75%, with expectations of limited additional cuts in 2026, but borrowing costs continue to constrain large projects

- Average effective tariff rates are 14-17 percentage points higher than pre-2025 levels, with ongoing policy uncertainty influencing equipment purchasing and project timing decisions

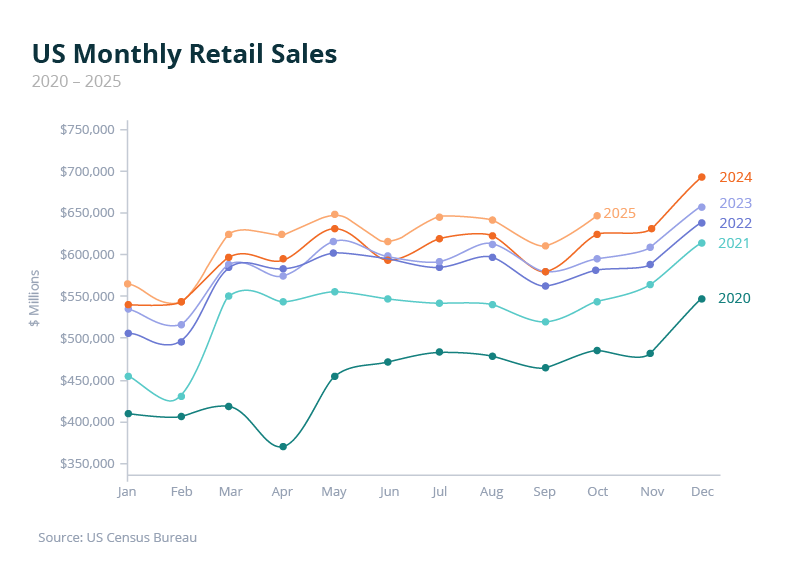

- The National Retail Federation reported 2025 holiday sales grew 4.1%, pushing total holiday spending to just over $1 trillion and reflecting resilient consumer spending

Efficiency, resilience, and adaptability are shaping how organizations pursue growth in 2026.

Customers are deferring non-essential upgrades while maintaining spending on infrastructure that keeps operations running or reduces costs. Hiring freezes across industries mean more work is shifting to contract and on-demand labor models. Project approval cycles remain longer as ROI scrutiny continues.

Recommended actions

- Track sector-specific spending patterns rather than relying on broad economic indicators

- Position services around maintenance, lifecycle extension, and operational efficiency

- Build workforce flexibility to support staggered project starts and shifting timelines

- Focus on categories showing sustained growth, such as data centers and security

2. Labor softness shifts workforce models

Hiring has slowed across industries as organizations take a cautious approach to permanent headcount. Rather than a talent shortage, the challenge now is speed to talent—the ability to quickly access qualified workers when project opportunities appear. This shift is accelerating the move toward variable labor models and flexible staffing.

Current workforce dynamics

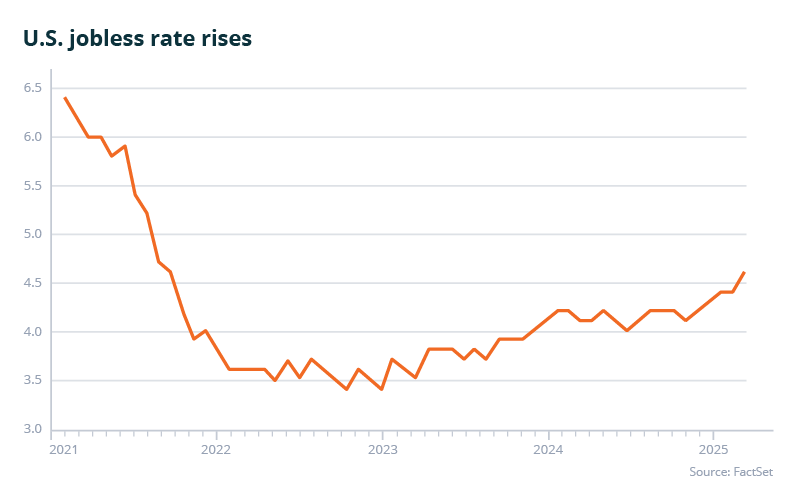

- Unemployment is rising into 2026, reaching 4.4-4.5% as job growth slows

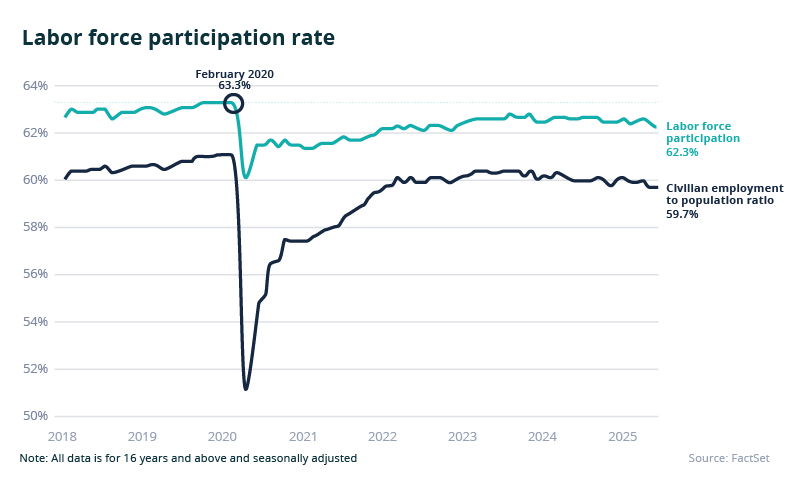

- Labor force participation remains below pre-pandemic levels, limiting the pool of experienced workers even as unemployment rises

- Field service labor shortages persist even as the broader labor market cools, driven by aging demographics and skills specialization

- Organizations are holding back on permanent hires while project work continues, creating demand for flexible staffing solutions

Permanent hiring has slowed, but service work continues. Organizations need technicians when projects move forward, but often can't commit to full-time headcount given economic uncertainty. Geographic coverage remains challenging as companies consolidate operations and reduce travel budgets. The ability to quickly deploy qualified technicians has become more valuable than maintaining large permanent workforces.

Recommended actions

- Develop hybrid workforce models combining W2 and on-demand labor

- Forge relationships with skilled technicians available for project-based work

- Create efficient onboarding processes that allow quick deployment

- Focus on utilization and efficiency rather than headcount expansion

3. Inefficiencies pressure performance

Field service organizations are struggling to maintain profitable growth while battling persistent operational inefficiencies. Industry data reveals systemic challenges in meeting both performance targets and customer expectations.

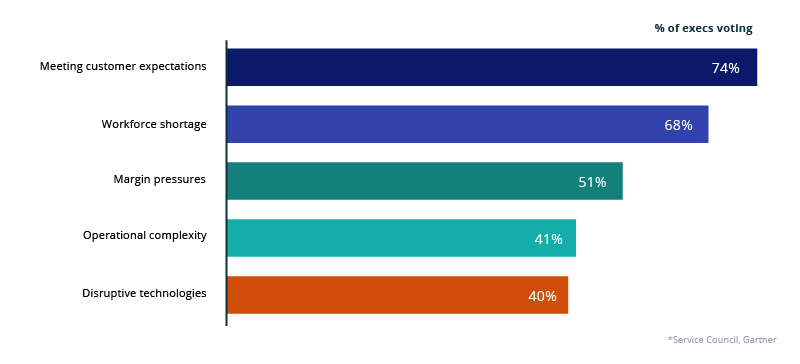

Major industry challenges

- Meeting customer expectations is the leading challenge, cited by 74% of field service leaders

- Workforce shortages constrain operations for 68% of organizations

- Margin pressures impact 51% of organizations

- Operational complexity affects 41% of service organizations

- Disruptive technologies challenge 40% of organizations

Low technician utilization and high travel costs continue to squeeze profit margins. Organizations struggle to maintain service levels while scaling operations efficiently.

Recommended actions

- Implement strategies to reduce fixed overhead costs

- Optimize scheduling and dispatch processes

- Develop local talent pools to minimize travel time

- Create flexible staffing models to improve utilization

- Build efficiency metrics into service delivery

- Leverage technology for better resource allocation

4. Retail’s physical-digital evolution

Retailers are moving forward with store optimization and modernization efforts as refresh and upgrade cycles ramp up. While consumer demand remains uneven, investments in store formats, fulfillment capabilities, and in-store technology are creating sustained demand for service delivery.

Current retail landscape

- Core retail sales show uneven category performance, with strong holiday spending alongside pockets of softness in select discretionary segments

- New store openings are expected to outpace closures in 2026, with 1,118 planned store openings announced so far

- Store closures remain elevated entering 2026, with hundreds of locations closing across pharmacy and specialty retail

Store format evolution

- Retailers are resuming refresh and remodel cycles while shifting toward smaller, more efficient store layouts focused on productivity and faster deployment

- Traditional department stores, big boxes, and pharmacy formats continue to experience closures as retailers rationalize footprints

- Conversion of remaining stores to support omnichannel:

- Enhanced pickup/return infrastructure

- Micro-fulfillment spaces

- BOPIS solution

- Technology infrastructure requirements continue to increase as stores take on expanded operational roles

- Networking work on the Field Nation marketplace grew 12.2% year over year, reflecting rising demand for store and fulfillment connectivity

- Cabling activity continues to rise as retailers modernize physical infrastructure, with cabling work up 8.3%

- Integrated POS systems connect in-store operations with fulfillment platforms, driving a 16.3% increase in point-of-sale projects

- Self-service kiosks expand customer service and checkout options, with kiosk-related work increasing 6.7%

Ongoing store openings and elevated closures are driving demand for both deployment and decommissioning services, while accelerating consolidation of geographic coverage needs. Rapid response times remain critical as downtime impacts both in-store operations and fulfillment workflows. Service organizations face growing complexity from interconnected systems and increased demand for multi-skilled technicians.

Recommended actions

- Scale capabilities to support both high-volume store openings and decommissioning activity while maintaining expertise in refreshes and conversions

- Build expertise in small-format retail equipment, networking, and in-store systems

- Create efficient processes for multi-site openings, refreshes, and technology rollouts

- Optimize workforce models to support simultaneous deployment and closure activity while maintaining flexibility across evolving coverage needs

5. Security analytics converge

Security systems continue to evolve beyond traditional surveillance as retailers combat rising theft and seek deeper business insights. Modern platforms combine AI-powered loss prevention with analytics for consumer behavior, store layout, and operational efficiency.

Current trends

Advanced loss prevention

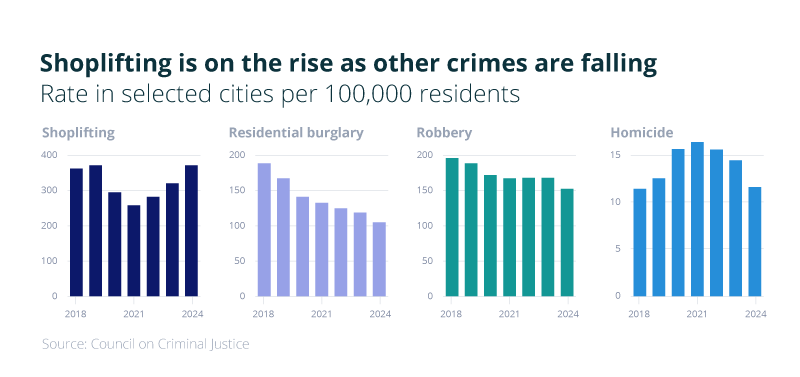

- Retailers reported a 19% increase in shoplifting and merchandise theft incidents from 2023 to 2024, according to an NRF study

- Over 60% of retailers report that organized retail crime is having a moderate to significant impact on profitability

- Retailers are expanding safety measures, including panic buttons, body-worn cameras, and exterior surveillance, to protect employees and customer

Analytics integration

- IP cameras increasingly support behavior analysis, traffic patterns, and investigation workflows

- Security platforms integrate with POS, transaction data, and inventory systems to identify anomalies

- AI-driven tools accelerate investigations, reduce manual review, and support faster response

Security system maintenance requires broader technical expertise as platforms expand beyond traditional surveillance to include analytics and business intelligence. Organizations must support integrated systems across multiple locations while maintaining rapid response capabilities for critical security infrastructure.

Recommended actions

- Build expertise in integrated security and analytics platforms

- Create efficient multi-site service delivery capabilities

- Establish rapid response protocols for critical infrastructure

- Prepare for sustained demand tied to ongoing upgrades, retrofits, and system integration

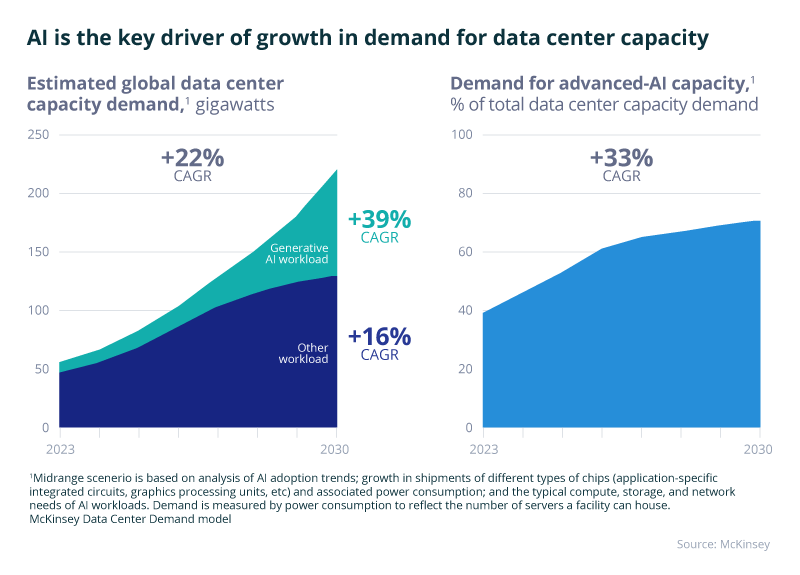

6. AI-driven data center growth

Data center construction has reached unprecedented levels as artificial intelligence, cloud computing, and big data drive demand for computing power. The global data center construction market, valued at $240.97 billion in 2024, is projected to grow at 11.8% annually through 2030.

Current trends

Market growth

- U.S. data center construction reaches all-time highs

- Edge computing drives demand for local data centers

- Power availability and grid constraints increasingly shape where and how data centers are built

- Long-term cloud demand continues to fuel infrastructure investment

Infrastructure requirements

- Advanced fiber optic cabling upgrades support increased bandwidth

- Hot-swap capabilities become standard for continuous operations

- Energy-efficient power and cooling technologies support sustainability goals

Growing demand for data center expertise requires specialized technical skills and flexible service delivery models. Organizations must manage complex infrastructure requirements while maintaining mission-critical systems. Regular technology refresh cycles create ongoing service opportunities.

Recommended actions

- Develop specialized data center service capabilities

- Build expertise in fiber and cooling infrastructure

- Create efficient deployment and upgrade processes

- Implement a variable workforce model for project work

7. AV and IT converge

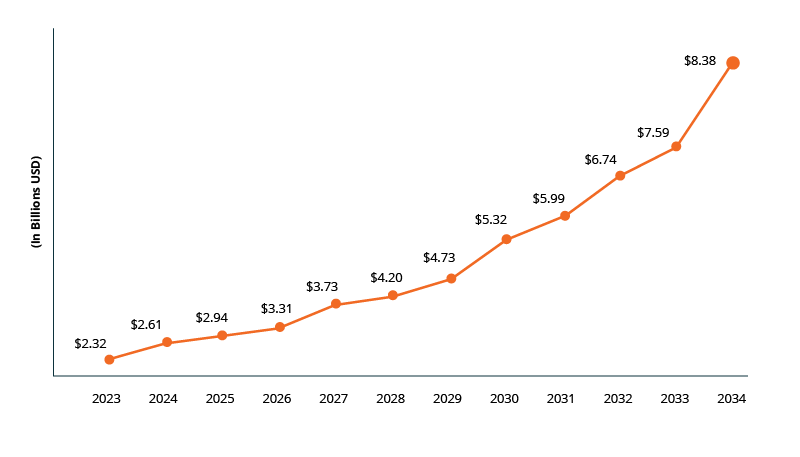

Audiovisual systems are evolving from standalone equipment into network-integrated smart devices, fundamentally changing how organizations deploy and maintain these technologies. This shift demands new technical skills and service delivery approaches. According to Precedence Research, the U.S. videoconference market will reach $28.26 billion by 2034.

Current trends

Enterprise integration

- AV systems transition from isolated installations to network-connected platforms

- Smart device connectivity becomes a standard requirement

- Network dependencies reshape system architecture

- “Room-in-a-box” solutions simplify deployments

Market evolution

-

- Corporate meeting spaces drive standardization

- Educational facilities upgrade digital capabilities

- Digital signage expands across sectors

- Video wall installations increase in complexity

Traditional AV expertise is giving way to IT-focused skills as installations become more network-centric. Organizations must develop network integration capabilities while shifting from complex AV deployments to standardized IT-based installations. The convergence of AV and IT creates demand for cross-trained technicians.

Recommended actions

- Develop IT networking expertise within AV teams

- Build standardized deployment processes

- Create pools of cross-trained AV technicians

- Align service delivery with IT standards